Commodities & Precious Metals Weekly Report: Oct 15

Posted:

Key points

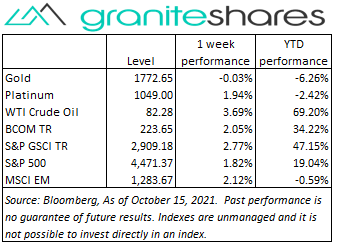

Energy prices, except for natural gas prices, moved higher again last week. WTI and Brent crude oil prices increased between 3% and 3.7%, gasoline prices rose over 4.5% and gasoil increased 3.5%. Natural gas prices fell 17%.

Energy prices, except for natural gas prices, moved higher again last week. WTI and Brent crude oil prices increased between 3% and 3.7%, gasoline prices rose over 4.5% and gasoil increased 3.5%. Natural gas prices fell 17%.- Grain prices were mixed with wheat prices unchanged or higher and corn and soybean prices lower. Kansas wheat prices rose almost a percent while Chicago wheat prices were unchanged. Corn prices decreased almost a percent and soybean prices fell over 2%.

- Precious metal prices were higher. Gold December futures prices increased over ½ percent and silver prices increased almost 3%. Platinum prices increased just shy of 2%.

- Base metal prices moved sharply higher last week with zinc prices surging over 20%. Copper prices increased 10.6%, aluminum prices rose 7.0% and nickel prices gained 4.2%.

- The Bloomberg Commodity Index gained 2.1%, benefiting from rising base metal and energy prices. The grains and livestock sectors detracted from the Index’s gains.

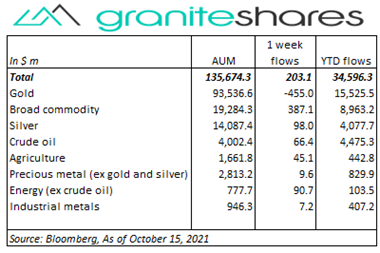

- Almost $250 million net inflows into commodity ETPs last week mainly from inflows into broad commodity ETPs but with decent inflows into almost all commodity ETPs and with only gold ETPs experiencing net outflows. Inflows included: Broad commodity ($387m), silver ($98m), energy (ex-crude oil) ($91m), crude oil ($66m) and agriculture ($58m). Gold ETPs experienced $455 million outflows.

Commentary

U.S. stock markets moved lower early last week pressured by inflation concerns arising from surging oil prices and continued shipping and production bottlenecks as well as by the advent of 3rd quarter earnings reports (the IMF’s lower global growth forecast Tuesday also pressured markets). Down close to 1% through Tuesday, U.S stock markets rallied the remainder of the week powered by better-than-expected bank earnings and stronger-than-expected retail sales and jobless claims. A record high CPI release Wednesday, while increasing expectations of Fed tapering sooner than later (confirmed by the FOMC minutes released Wednesday), seemingly had little effect on markets. Thursday’s lower-than-expected PPI release may have eased those expectations perhaps helping U.S stock markets to power 1.5% to 1.7% higher. The 10-year U.S. Treasury rate, reacting conversely to Fed tapering expectations, fell 10bps through Thursday but rose 6bps Friday to finish the week lower by 4bps. Interestingly the U.S dollar (as measured by the DXY Index), stronger by ½ percent through Tuesday, weakened almost ½ percent Wednesday and finished the week lower by 0.1%. For the week, the S&P 500 Index rose 1.8% to 4,471.37, the Nasdaq Composite Index jumped 2.2% to 14,897.30, the Dow Jones Industrial Average gained 1.6% to 35,295.48, the 10-year U.S. Treasury rate fell 4bps to 1.57% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.1%.

U.S. stock markets moved lower early last week pressured by inflation concerns arising from surging oil prices and continued shipping and production bottlenecks as well as by the advent of 3rd quarter earnings reports (the IMF’s lower global growth forecast Tuesday also pressured markets). Down close to 1% through Tuesday, U.S stock markets rallied the remainder of the week powered by better-than-expected bank earnings and stronger-than-expected retail sales and jobless claims. A record high CPI release Wednesday, while increasing expectations of Fed tapering sooner than later (confirmed by the FOMC minutes released Wednesday), seemingly had little effect on markets. Thursday’s lower-than-expected PPI release may have eased those expectations perhaps helping U.S stock markets to power 1.5% to 1.7% higher. The 10-year U.S. Treasury rate, reacting conversely to Fed tapering expectations, fell 10bps through Thursday but rose 6bps Friday to finish the week lower by 4bps. Interestingly the U.S dollar (as measured by the DXY Index), stronger by ½ percent through Tuesday, weakened almost ½ percent Wednesday and finished the week lower by 0.1%. For the week, the S&P 500 Index rose 1.8% to 4,471.37, the Nasdaq Composite Index jumped 2.2% to 14,897.30, the Dow Jones Industrial Average gained 1.6% to 35,295.48, the 10-year U.S. Treasury rate fell 4bps to 1.57% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.1%.

Oil prices continued their move higher last week, pausing briefly mid-week following API and EIA reports of unexpected large increases in U.S. oil inventories. Strong oil demand, assisted by skyrocketing natural gas prices, OPEC+ refusal to add to production increases and restrained U.S. shale oil production pushed oil prices over $81/barrel to 3-year highs. A natural gas shortage, leading to surging natural gas prices has, according to an IEA report released Thursday, increased oil demand by 500,000 barrel/day. In that same report, the IEA forecasted a 200,000 barrel/day increase in oil demand next year

A volatile week for gold prices, surging on another higher-than-expected CPI release Wednesday and then falling Friday after a much stronger-than-expected retail sales increase. Wednesday’s CPI released increased concerns of slowing economic growth because of persistently high, structural inflation, pushing real yields lower (down 12bps to -1.02% through Thursday), weakening the U.S. dollar and driving gold prices higher. Friday’s retail sales report partially alleviated those concerns with real yields rising 3bps to -0.99% and gold prices retreating.

Base metal prices once again moved sharply higher last week as Europe’s and China’s severe power shortage worked to drastically reduce supply. Concerns of power-shortage-related slower growth switched to tangible supply shortages for most base metals. LME copper inventory levels fell to 47-year lows amidst increasing production cutbacks due to surging power costs. Zinc prices, up over 20% last week, rose on the back of Nyrstar’s announcement it would cut its European smelter production by 50% and as Glencore said it would adjust its European production lower. Aluminum prices reached 13-year highs as China continued to restrict production due to high energy costs (aluminum production is highly energy intensive).

Corn and soybean prices moved lower early last week mainly due to Tuesday’s USDA WASDE report showing higher-than-expected yield and ending stock levels. Down almost 3.5% through Wednesday, corn prices, supported by strong export numbers, moved higher the remainder of the week. Soybean prices also moved off Wednesday’s lows but not as strongly as corn prices.

Coming up this week

Housing data, Industrial Production, PMI Composite Index highlighting a fairly light week

Housing data, Industrial Production, PMI Composite Index highlighting a fairly light week- Industrial Production and Housing Market Index on Monday.

- Housing Starts and Permits on Tuesday.

- Jobless Claims, Philadelphia Fed Mfg Index and Existing Home Sales on Thursday.

- PMI Composite Flash on Friday.

- EIA Petroleum Status Report on Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.