Commodities & Precious Metals Weekly Report: Oct 22

Posted:

Key points

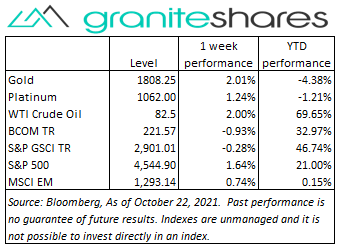

Energy prices were mixed last week with crude oil prices increasing and all other prices falling. WTI crude oil prices rose 2% and Brent crude oil prices increased 0.6%. Gasoline prices fell a little over ½ percent and heating prices decreased 1 ¼ percent. Natural gas prices dropped 2.5%.

Energy prices were mixed last week with crude oil prices increasing and all other prices falling. WTI crude oil prices rose 2% and Brent crude oil prices increased 0.6%. Gasoline prices fell a little over ½ percent and heating prices decreased 1 ¼ percent. Natural gas prices dropped 2.5%.- Grain prices were all higher with wheat prices increasing the most. Kansas and Chicago wheat prices rose 4% and 3%, respectively, corn prices increased 2.3% and soybean prices gained less than ½ percent.

- Precious metal prices were higher as well. Gold December futures prices increased 1.6% and silver prices increased almost 5%. Platinum prices increased 1.2%.

- Base metal prices moved sharply lower last week with aluminum and zinc prices dropping the most. Aluminum and zinc prices lost 9.5% and 9%, respectively, copper prices fell just under 5%, and nickel prices decreased 1.3%.

- The Bloomberg Commodity Index decreased just under 1%, mainly as a result of lower base metal prices. Positive performance in the grains and precious metals sectors helped offset losses.

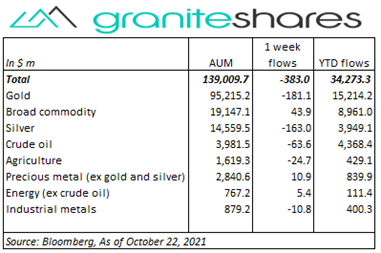

- Just under $400 million net outflows from commodity ETPs last week, mainly due to gold (-$181m), silver (-$163m) and crude oil (-$63m) ETP outflows. Broad commodity ($44m) ETP inflows partially offset outflows.

Commentary

U.S. stock markets moved higher last week with the Dow Jones Industrial Average closing at a record high and the S&P 500 Index finishing slightly off its record high set Thursday. Strong earnings reports were the primary driver behind last week’s gains, overcoming concerns of lower profits due to rising input and labor costs and production and shipping bottlenecks. Lower-than-expected jobless claims, reported Thursday, also helped move markets higher. Three notable earnings misses – Intel, Snap and IBM – helped push the Nasdaq Composite Index and the S&P 500 Index lower Friday though analysts mostly considered these misses as outliers either because they were considered exceptions (IBM) or because of the unique, specific nature of the misses (Snap, Intel). Better-than-expected earnings reports, however, did not alleviate concerns of persistent inflation, driving the 10-year Treasury rate 12bps higher through Thursday. The rate fell almost 6bps Friday, likely reacting to weaker-than-expected earnings reports. At week’s end, the S&P 500 Index rose 1.6% to 4,544.90, the Nasdaq Composite Index increased 1.3% to 15,090.20, the Dow Jones Industrial Average gained 1.1% to 35,677.02, the 10-year U.S. Treasury rate rose 7bps to 1.64% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.3%.

U.S. stock markets moved higher last week with the Dow Jones Industrial Average closing at a record high and the S&P 500 Index finishing slightly off its record high set Thursday. Strong earnings reports were the primary driver behind last week’s gains, overcoming concerns of lower profits due to rising input and labor costs and production and shipping bottlenecks. Lower-than-expected jobless claims, reported Thursday, also helped move markets higher. Three notable earnings misses – Intel, Snap and IBM – helped push the Nasdaq Composite Index and the S&P 500 Index lower Friday though analysts mostly considered these misses as outliers either because they were considered exceptions (IBM) or because of the unique, specific nature of the misses (Snap, Intel). Better-than-expected earnings reports, however, did not alleviate concerns of persistent inflation, driving the 10-year Treasury rate 12bps higher through Thursday. The rate fell almost 6bps Friday, likely reacting to weaker-than-expected earnings reports. At week’s end, the S&P 500 Index rose 1.6% to 4,544.90, the Nasdaq Composite Index increased 1.3% to 15,090.20, the Dow Jones Industrial Average gained 1.1% to 35,677.02, the 10-year U.S. Treasury rate rose 7bps to 1.64% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.3%.

Oil prices moved higher again last week though with increased volatility. Smaller-than-expected US industrial production growth and weakening Chinese economic activity pushed prices lower Monday only to have those losses more than recouped Tuesday and Wednesday as falling temperatures in China exacerbated energy-shortage concerns and as Wednesday’s EIA report showed an unexpected drop in oil, gas and distillate inventories. Falling coal prices (resulting from Chinese statements it may intervene in coal markets) and the NOAA’s forecast calling for a warmer-than-average winter in the US pressured oil priced lower Thursday. Nonetheless, prices moved higher Friday amidst renewed natural gas and coal supply concerns in China, India and Europe.

Gold prices moved higher last week amid growing unease of persistent, structural inflation. Soaring energy prices, production and shipping bottlenecks combined with continued pent-up demand has increased concerns of resilient inflation alongside struggling economic growth. A weaker US dollar also supported gold prices and while 10-year Treasury rates were higher on the week, 10-year real yields closed the week 1bp lower at 1.0%, down 8bps from its intraweek high.

Base metal prices, with the exception of nickel prices, moved sharply lower last week. The main impetus behind the decline was falling coal (and to a lesser extent natural gas) prices, precipitated by China’s intent to intervene in coal markets to push prices lower. Slowing Chinese economic activity also acted to pressure prices lower. Nickel prices, while down a little over a 1% on the week, were supported by mining disruptions in Canada and the Philippines as well as by Indonesian export restrictions. The spread between spot copper and 3-month forward prices soared (a situation known as steep backwardation), reaching levels not seen since 1994, prompting the LME to initiate spread price limits and permit some short copper positions to defer delivery.

Grain prices were all higher last week with wheat prices increasing the most. Strong demand for wheat combined with drought conditions in the US and Russia as well as rising fertilizer prices all combined to lift wheat prices higher. Soybean and corn prices also benefited from strong demand with corn prices also benefiting from rising oil demand and prices resulting in increased ethanol demand and prices.

Coming up this week

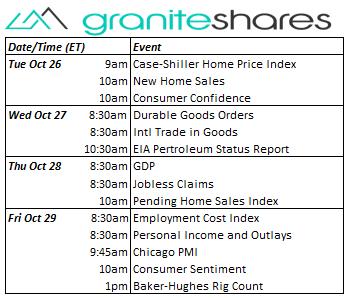

- More housing data (Monday, Wednesday), gauges of consumer health (Monday, Friday), GDP (Thursday) and PCE Price Index (Friday) highlight data releases this week.

- Cas-Shiller Home Price Index, New Home Sales and Consumer Confidence on Monday.

- Durable Goods Orders and Intl Trade in Goods on Tuesday

- GDP, Jobless Claims and Pending Home Sales Index on Thursday

- Employment Cost Index, Personal Income and Outlays, Chicago PMI and Consumer Sentiment on Friday.

- EIA Petroleum Status Report on Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.