Commodities & Precious Metals Weekly Report: Sep 1

Posted:

Key points

Energy prices were mixed with oil prices higher but gasoline, heating oil and natural gas prices lower. Oil prices rose between 6% and 7%. Natural gas and gasoline prices fell about 1%. Heating oil prices lost close to 4%.

Energy prices were mixed with oil prices higher but gasoline, heating oil and natural gas prices lower. Oil prices rose between 6% and 7%. Natural gas and gasoline prices fell about 1%. Heating oil prices lost close to 4%.- Grain prices were all lower. Wheat prices fell between 4% and 5% and corn and soybean prices lost 1%.

- Spot gold prices increased 1%, spot silver prices fell less than ½ percent and platinum prices rose 2%.

- Aluminum, zinc and lead prices increased 4%. Copper and nickel prices gained between 1% and 2%.

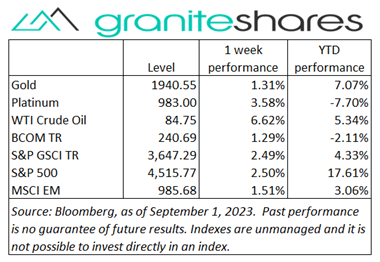

- The Bloomberg Commodity Index increased 1.3%, benefiting from increasing energy and base and precious metals sectors.

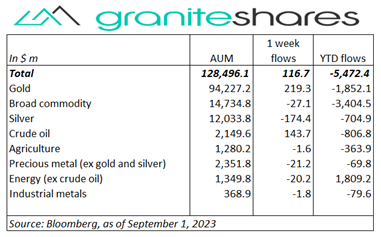

- Finally, a week of inflows. Gold and crude oil ETP inflows were partially offset by silver ETP outflows.

Commentary

All 3 major indexes moved higher last week, powered mainly by investor reassessment of the strength of the economy and, as a result, of a possible relaxing of the Fed’s current monetary policy. Weaker-than-expected JOLTS and consumer confidence releases early last week seemingly accentuated Fed Chair Powell’s “proceed with caution” Jackson Hole comments, increasing expectations of a less aggressive Fed, pushing Treasury rates lower and stock prices higher. More (but less) of the same followed with an unexpected revision lower to Q2 GDP. Thursday’s PCE Price Index release, while generally reflecting a slowing in core and headline inflation, also showed continued higher-than-desired (by the Fed) wage and services inflation, increasing (at least momentarily) uncertainty regarding the Fed’s future course of action. Friday’s weaker-than-expected Jobs Report, also seemingly increased uncertainty with lower-than-expected jobs created offset by slightly higher-than-expected wage growth. 10-year Treasury rates, down 13bps through Thursday, rose 8bps Friday (following the Jobs Report), finishing the week 5bps lower. The move lower was entirely due to falling 10-year inflation expectations. For the week, the S&P 500 Index increased 2.5% to 4,515.77, the Nasdaq Composite Index climbed 3.3% to 14,031.82, the Dow Jones Industrial Average rose 1.4% to 34,838.01, the 10-year U.S. Treasury rate decreased 5bps to 4.18% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.2%.

All 3 major indexes moved higher last week, powered mainly by investor reassessment of the strength of the economy and, as a result, of a possible relaxing of the Fed’s current monetary policy. Weaker-than-expected JOLTS and consumer confidence releases early last week seemingly accentuated Fed Chair Powell’s “proceed with caution” Jackson Hole comments, increasing expectations of a less aggressive Fed, pushing Treasury rates lower and stock prices higher. More (but less) of the same followed with an unexpected revision lower to Q2 GDP. Thursday’s PCE Price Index release, while generally reflecting a slowing in core and headline inflation, also showed continued higher-than-desired (by the Fed) wage and services inflation, increasing (at least momentarily) uncertainty regarding the Fed’s future course of action. Friday’s weaker-than-expected Jobs Report, also seemingly increased uncertainty with lower-than-expected jobs created offset by slightly higher-than-expected wage growth. 10-year Treasury rates, down 13bps through Thursday, rose 8bps Friday (following the Jobs Report), finishing the week 5bps lower. The move lower was entirely due to falling 10-year inflation expectations. For the week, the S&P 500 Index increased 2.5% to 4,515.77, the Nasdaq Composite Index climbed 3.3% to 14,031.82, the Dow Jones Industrial Average rose 1.4% to 34,838.01, the 10-year U.S. Treasury rate decreased 5bps to 4.18% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.2%.

Oil prices moved higher every single day last week. Gulf coast production concerns precipitated by Hurricane Idalia supplied early-week impetus for higher prices followed by growing hopes of a more restrained Fed after weaker-than-expected JOLTS, consumer confidence and GDP reports. Expectations of continued OPEC+ production/export cutbacks through October and a larger-than-expected decline in U.S. inventories also helped move prices higher the remainder of the week. Oil prices ended the week up between 6% and 7% while gasoline prices lost about 1% and heating oil prices declined close to 4%. Heating oil prices fell on continued inventory increases.

Spot gold prices rose again last week (up 1.3%), benefiting from a slew of weaker-than-expected economic data (JOLTS, consumer confidence, GDP). Thursday’s PCE Price Index and Friday’s Jobs Report, both providing reason for Fed moderation and for continued Fed vigilance, added somewhat to uncertainty, pushing prices slightly lower. Silver prices ended the week ½ percent lower while platinum prices gained 1.7%.

Copper prices moved higher again last week, supported by Chinese measures to support its stock and property markets. Prices fell Thursday after China’s official PMI Index release showed continued manufacturing weakness but then moved higher Friday following a private-sector survey revealing stronger-than-expected activity/growth.

Grain prices finished lower last week despite continued hot, dry weather forecasts for the U.S., Australia and Argentina. Wheat prices suffered from continued expansive Russian exports, reports of an alternative Black Sea agreement/corridor and worries surrounding Chinese demand. Soybean prices moved lower on better-than-expected crop progress reports while corn prices moved lower with soybean prices, strong Brazil exports and better-than-expected crop ratings.

Coming Up This Week

Very light week with ISM Services Index Wednesday the main highlight.

Very light week with ISM Services Index Wednesday the main highlight.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.