Commodities & Precious Metals Weekly Report: Sep 15

Posted:

Key points

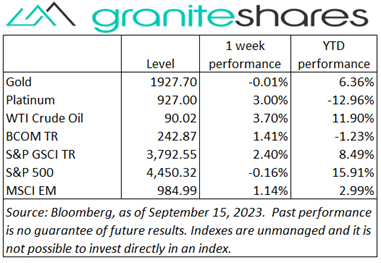

Energy prices, except for natural gas prices (again), were all higher. WTI, Brent Crude and heating oil prices gained 3% and gasoline and gasoil prices increased 2%. Natural gas prices fell 1%.

Energy prices, except for natural gas prices (again), were all higher. WTI, Brent Crude and heating oil prices gained 3% and gasoline and gasoil prices increased 2%. Natural gas prices fell 1%.- Grain prices were mixed. Wheat prices were up 1% - 2%. Soybean and corn prices fell 2%.

- Spot gold prices increased ¼ percent. Spot silver prices rose ½ percent and platinum and palladium prices gained 4%.

- Copper, zinc and lead prices increased 2%. Aluminum prices were almost unchanged and nickel prices fell 1%.

- The Bloomberg Commodity Index increased 1.4%. Over half the gain came from the energy sector with the remainder spread out fairly evenly between the other sectors.

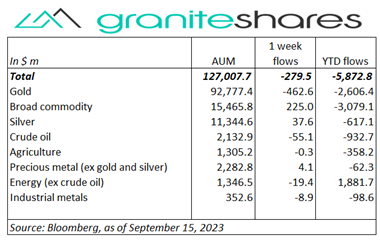

- More outflows, again mainly from gold ETPs, though with decent inflows into broad commodity funds.

Commentary

Stock markets started last week on a positive note, climbing on reports of Tesla’s supercomputer development to power its driverless-system capabilities. Markets retreated slightly Tuesday following Oracle’s downbeat guidance/forecast but continued higher Wednesday and Thursday after a mainly-as-expected CPI release Wednesday powered hopes of a resilient economy despite continued vigilance from the Fed. Friday, however, saw that optimism fade, triggered by a disappointing Adobe earnings report, a sustained rally in oil prices and a surprise decline in consumer sentiment. All 3 major stock market indexes, up 1% through Thursday, experienced sharp declines, driving both the S&P 500 and Nasdaq Composite Indexes slightly into the red and Dow Jones Industrial Average to almost unchanged. For the week, the S&P 500 Index decreased 0.2% to 4,450.32, the Nasdaq Composite Index dropped 0.4% to 13,704.70, the Dow Jones Industrial Average increased 0.1% to 34,618.77, the 10-year U.S. Treasury rate rose 7bps to 4.33% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.2%.

Stock markets started last week on a positive note, climbing on reports of Tesla’s supercomputer development to power its driverless-system capabilities. Markets retreated slightly Tuesday following Oracle’s downbeat guidance/forecast but continued higher Wednesday and Thursday after a mainly-as-expected CPI release Wednesday powered hopes of a resilient economy despite continued vigilance from the Fed. Friday, however, saw that optimism fade, triggered by a disappointing Adobe earnings report, a sustained rally in oil prices and a surprise decline in consumer sentiment. All 3 major stock market indexes, up 1% through Thursday, experienced sharp declines, driving both the S&P 500 and Nasdaq Composite Indexes slightly into the red and Dow Jones Industrial Average to almost unchanged. For the week, the S&P 500 Index decreased 0.2% to 4,450.32, the Nasdaq Composite Index dropped 0.4% to 13,704.70, the Dow Jones Industrial Average increased 0.1% to 34,618.77, the 10-year U.S. Treasury rate rose 7bps to 4.33% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.2%.

Oil moved higher again last week, driven by both supply and demand factors. Tuesday the EIA forecasted oil demand growth into next year would outpace oil production increases, with a significant decline in inventories through year-end. The IEA on Wednesday, however, reduced its demand growth projections for the Q4 by 600,000 bpd though added OPEC+ production cutbacks would result in a supply deficit. This combined with a surprise increase in U.S. inventories resulted in the only down-day for oil, with prices declining a meager 1/3 percent. Positive economic data out of China, including growing bank loans, no deflation and better-than-expected retail sales and industrial production, added to demand expectations, providing another impetus for higher prices.

Spot gold prices edged higher last week, moving higher Thursday and Friday and erasing intraweek losses through Wednesday. Prices moved lower in front of uncertainty surrounding Wednesday’s CPI release and as a result of a strengthening U.S. dollar. Wednesday’s mostly as-expected CPI release seemed to support prices Thursday despite higher-than-expected PPI and retail sales data. Prices moved markedly higher Friday, seemingly supported by renewed recession concerns following a weak Adobe earnings report and a surprise decline in consumer sentiment. Silver prices also edged higher last week while platinum and palladium prices rose 4%, moving more in tandem with base metal prices.

Copper gained over 2% last week mainly as a result of Chinese stimulus measures and much better-than-expected Chinese economic data. The gain occurred despite a stronger U.S. dollar.

Wheat prices moved higher last week, supported by forecasts calling for El Nino weather conditions through March, drought conditions in Canada and drought-affected crops in Argentina. The EU ban on Ukraine grain imports, though set to expire, will likely be de-facto extended by individual countries (if not extended by the EU), also supported wheat prices. Both corn and soybean prices moved lower, reacting negatively to Tuesday’s USDA WASDE report, showing slightly better-than-expected or as-expected supply/demand conditions. Corn prices were also pressured lower by China’s raising their corn production forecast.

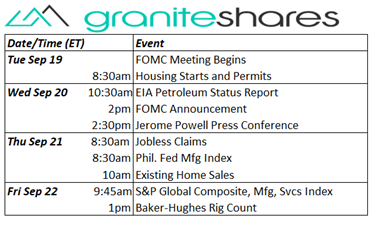

Coming Up This Week

FOMC, FOMC, FOMC, interspersed with other data releases.

FOMC, FOMC, FOMC, interspersed with other data releases.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.