Commodities & Precious Metals Weekly Report: Sep 4

Posted:

Key points

Energy prices were all significantly lower last week except for natural gas. WTI and Brent crude oil, heating oil and gasoil prices fell approximately 7%. Gasoline prices fell 5%. Natural gas prices rose almost 2.5%.

Energy prices were all significantly lower last week except for natural gas. WTI and Brent crude oil, heating oil and gasoil prices fell approximately 7%. Gasoline prices fell 5%. Natural gas prices rose almost 2.5%. - Wheat prices and corn prices were almost unchanged last week. Soybean prices increased approximately 2%.

- Lean hog prices surged 11.5%.

- Copper prices continued to increase last week while all other base metal prices decreased. Copper prices increased close to 1.5% with aluminum, zinc and nickel prices declining between 0.5% and 1.5%.

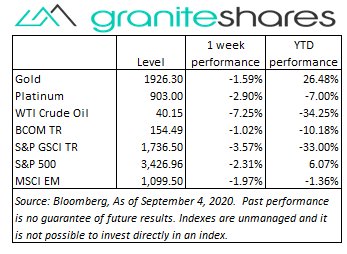

- Precious metal prices all moved lower last week. Gold prices lost 1.6%, platinum prices fell 2.9% and silver prices dropped almost 4%.

- Hurt by weaker energy and precious metal prices, the Bloomberg Commodity Index decreased 1.02%. All other sector performance was positive.

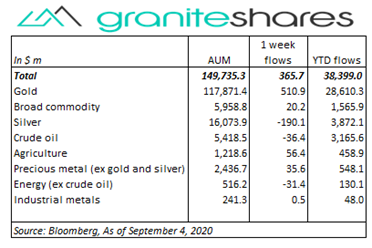

- Commodity ETP assets increased again last week, adding $365 million. Gold ETP assets increased the most, adding a little over $500 million. Agriculture, precious metal (ex-gold and silver) and broad commodity ETP assets increased a combined $125 million. Silver and energy (ex-crude oil) ETPs experienced outflows, with silver ETPs assets falling $190 million.

Commentary

Finishing its best August in 34 years and up 2% through Wednesday, the S&P 500 Index fell 3.5% on Thursday on no real news and despite better-than-expected ISM and PMI manufacturing index numbers, factory orders and jobless claims. The Nasdaq Composite Index behaved similary falling almost 5% on Thursday after increasing 3% through Wednesday. Both the S&P 500 Index and the Nasdaq Composite Index declined close to 1% on Friday as well. Tech stocks were the main impetus for the sell off in the indexes sell off, seemingly giving up some of their meteroic gains after powering both indexes over 60% higher from their March lows. At week’s end the S&P 500 Index decreased 2.3% to 3,426.96, the Nasdaq Composite index fell 3.3% to 11,313.13, the 10-year U.S. interest rate was unchanged 72 bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.4%.

Finishing its best August in 34 years and up 2% through Wednesday, the S&P 500 Index fell 3.5% on Thursday on no real news and despite better-than-expected ISM and PMI manufacturing index numbers, factory orders and jobless claims. The Nasdaq Composite Index behaved similary falling almost 5% on Thursday after increasing 3% through Wednesday. Both the S&P 500 Index and the Nasdaq Composite Index declined close to 1% on Friday as well. Tech stocks were the main impetus for the sell off in the indexes sell off, seemingly giving up some of their meteroic gains after powering both indexes over 60% higher from their March lows. At week’s end the S&P 500 Index decreased 2.3% to 3,426.96, the Nasdaq Composite index fell 3.3% to 11,313.13, the 10-year U.S. interest rate was unchanged 72 bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.4%.

WTI Crude oil prices, down slightly through Tuesday, fell almost 3% on Wednesday despite a much-larger-than-expected drawdown in U.S. oil inventories as reported by the EIA. WTI crude oil prices continued to fall through Friday, losing another 4% from Wednesday’s closing levels. Planned refinery maintenance shutdowns, increased production after Hurricane Laura related production cutbacks and lower-than-expected demand for gasoline (as reported by the EIA) and continued coronavirus demand concerns all pressured oil prices lower.

Increasing through Tuesday on the back of the Fed Chairman Powell’s comments the previous week that the Fed will persevere with its accommodative monetary policy allowing inflation and employment rate to overshoot targets, gold prices fell 1.5% on Wednesday following much-stronger-than-expected factory orders and a strengthening of the U.S. dollar. Gold prices moved lower the remainder of the week with better-than-expected weekly jobless claims and as the U.S. dollar continued to strengthen. Silver and platinum prices followed gold prices.

Copper prices continued their march higher supported by strong Chinese demand, strong economic reports in the U.S. and China and supply concerns. Aluminum and zinc prices, both higher through Tuesday, fell as the U.S. dollar strengthened. Nickel prices, up 2% through Wednesday, fell close to 2.5% over Thursday and Friday on weaker spot demand.

Soybean and corn prices continued to be supported by fallout from the derecho storm, hot and dry U.S weather and strong Chinese demand amplified by hurricane-related weather potentially affecting China corn harvests and yields. Wheat prices, though basically unchanged, continued to be supported by global supply concerns.

Lean hog prices rose on much-larger-than-expected Chinese imports.

Coming up this week

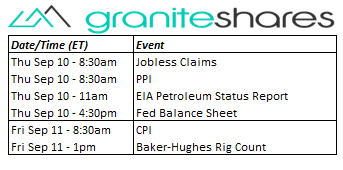

Very light holiday-shortened data week.

Very light holiday-shortened data week.- Jobless Claims, PPI and Fed Balance Sheet on Thursday.

- CPI on Friday.

- EIA petroleum report on Thursday and Baker-Hughes rig count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.