Commoditized Wisdom: Metals & Markets Update #53

Posted:Key points

Energy prices all moved higher last week increasing between 1% and a little over 2%. Gasoline prices increased the most, gaining 2.2% while heating oil prices increased the least, rising 1%.

Energy prices all moved higher last week increasing between 1% and a little over 2%. Gasoline prices increased the most, gaining 2.2% while heating oil prices increased the least, rising 1%. - Grain prices powered higher last week. Corn and soybean prices rose 5.5% and wheat prices gained between 4.5% and 5.5%.

- Base metal prices, too, all moved higher last week with copper and nickel prices gaining the most. Nickel prices move 4.5% higher, Copper prices increased almost 3%, zinc prices gained 2.4% and aluminum prices rose 1.8%.

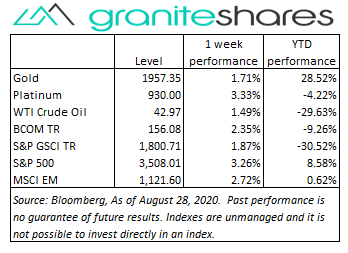

- Precious metal prices all moved higher as well, with platinum and silver increasing about 3.3% and gold prices rising 1.7%.

- The Bloomberg Commodity Index rose for the fifth consecutive week, increasing 2.35% and is now up 20% since the end of April. The grains sector contributed most to last week’s gains followed almost equally by the base metals, energy and precious metals sectors. The livestock sector was the only negative performing sector detracting about 13bps from the index over the week.

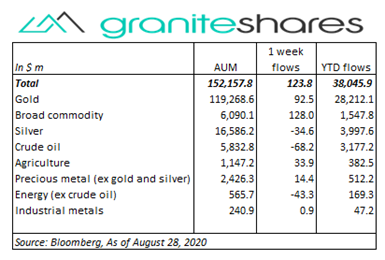

- Commodity ETP assets slightly increased last week, adding $123.8m. Broad commodity ($128.0m), gold ($92.5m) and agriculture ($33.9m) ETP inflows were offset by crude oil (-$68.2m), energy (ex-crude oil) (-$43.3m) and silver (-$34.6m) ETP outflows.

Commentary

U.S. stock markets moved higher last week with both the S&P 500 Index and the Nasdaq Composite Index closing at all-time highs and with the Dow Jones Industrial Average finishing the week flat on the year. Stronger-than-expected economic reports, the continuation of U.S.-China trade talks, positive Covid-19 treatment developments combined with Fed Chairman Jerome Powell’s comments declaring the U.S. Federal Reserve Bank will allow inflation and employment targets to overshoot targets were mainly responsible for strong market performance while at the same time helping push U.S. Treasury rates higher and weaken the U.S. dollar. At week’s end the S&P 500 Index increased 3.3% to 3,508.01, the Nasdaq Composite index rose 3.4% to 11,695.63, the 10-year U.S. interest rate increased 9bps bps to 72 bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.9%.

U.S. stock markets moved higher last week with both the S&P 500 Index and the Nasdaq Composite Index closing at all-time highs and with the Dow Jones Industrial Average finishing the week flat on the year. Stronger-than-expected economic reports, the continuation of U.S.-China trade talks, positive Covid-19 treatment developments combined with Fed Chairman Jerome Powell’s comments declaring the U.S. Federal Reserve Bank will allow inflation and employment targets to overshoot targets were mainly responsible for strong market performance while at the same time helping push U.S. Treasury rates higher and weaken the U.S. dollar. At week’s end the S&P 500 Index increased 3.3% to 3,508.01, the Nasdaq Composite index rose 3.4% to 11,695.63, the 10-year U.S. interest rate increased 9bps bps to 72 bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.9%.

Up 2.5% through Wednesday in anticipation of the onset of Hurricane Laura in the Gulf, WTI crude oil prices retreated about a 1% from its Wednesday’s high to finish the week up just over 1.5%. Over 80% of oil and about 60% of natural gas production had been shut down in advance of the storm. Following landfall and less-than-expected damage, WTI crude oil prices traded lower. Gasoline prices behaved similarly. Interestingly, natural gas prices moved higher after the storm’s passage as a result of fewer power outages than had been expected.

Down a little over 1% through Tuesday on strong durable goods orders and positive Covid-19 treatment developments, gold prices climbed almost 3% from their intraweek lows mainly as a result of Fed Chairman Powell’s comments at Jackson Hole indicating the U.S. Federal Reserve Bank will persevere with its accommodative monetary policy allowing inflation and employment rates to overshoot targets. A weaker U.S. dollar also contributed to gold’s gain. Silver prices behaved similarly to gold prices, falling about 2% through Tuesday and then rallying about 5% from their intraweek lows.

Base metal prices continued their move higher supported by strong U.S. economic reports, falling supplies and strong Chinese demand. Positive developments regarding a Covid-19 treatment, continuation of U.S. –China trade talks and a weaker U.S. dollar also supported prices. Nickel prices, up over 4.5% on the week, reached a 9-month high while copper prices continued to reach new 2-year highs.

Continued fallout from the derecho storm, dry, hot weather and strong Chinese demand all combined to move corn and soybean prices over 5% higher last week. An extremely poor wheat harvest has supported wheat prices, moving them almost 10% higher over the last two weeks.

Coming up this week

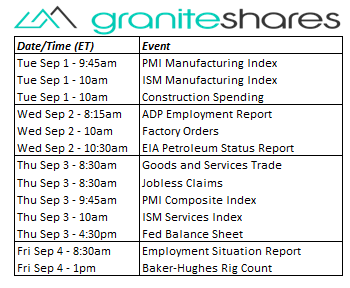

Full week of data dotted with PMI and ISM index releases and capped of with Employment Situation report on Friday.

Full week of data dotted with PMI and ISM index releases and capped of with Employment Situation report on Friday.- ISM and PMI Manufacturing Indexes and Construction Spending on Tuesday

- ADP Employment Report and Factory Orders on Wednesday.

- Goods and Services Trade, Jobless Claims, PMI Composite Index, ISM Services Index and Fed Balance Sheet on Thursday.

- Employment Situation Report on Friday.

- EIA petroleum report on Wednesday and Baker-Hughes rig count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.