Commodities & Precious Metals Weekly Report: Nov 27

Posted:

Key points

- Energy prices were sharply higher last week with gasoline price increasing the most. Gasoline prices increased over 8% while crude oil prices gained a little over 7%. Natural gas prices increased 2.5%.

- Grain prices were all higher as well last week with wheat, corn and soybean prices all increasing about 1%.

- Base metal prices were mainly higher with copper prices hitting multi-year highs. Copper prices increased over 3% and nickel prices gained almost 2%. Aluminum and zinc prices were basically unchanged.

- Gold and silver prices were weaker last week with gold prices losing about 5% and silver prices falling just shy of 8%.

- Coffee prices increased 5% again last week.

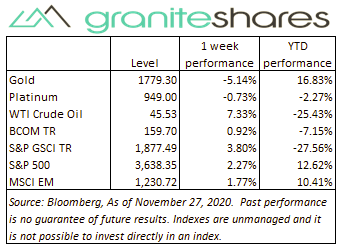

- The Bloomberg Commodity rose again last week, increasing 0.92%, its 4th consecutive weekly gain. The energy sector contributed the most to last week’s gain followed by base metals and grains. The precious metals sector was the only sector with negative performance last week.

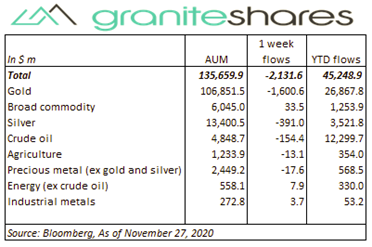

- Total assets in commodity ETPs fell again last week, falling another $2.1 billion. Gold ETP outflows were once againthe predominate reason for the decline followed by silver, and crude oil ETP outflows.

Commentary

U.S. stock markets powered higher early last week, with the S&P 500 Index, for example, rising over 2% through Tuesday. Continued positive news regarding Covid-19 vaccines and prophylactics, the market’s positive reception to news Janet Yellen may be the next treasury secretary and historically low interest rates helped move U.S. equity markets to record highs last week despite rising Covid-19 cases and larger-than-expected jobless claims. At week’s end the S&P 500 Index increased 2.3% to 3,638.35, the Nasdaq Composite Index increased 3.0% to 12,205.85, the 10-year U.S. Treasury rate rose 2bps to 85bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened another 0.7%.

U.S. stock markets powered higher early last week, with the S&P 500 Index, for example, rising over 2% through Tuesday. Continued positive news regarding Covid-19 vaccines and prophylactics, the market’s positive reception to news Janet Yellen may be the next treasury secretary and historically low interest rates helped move U.S. equity markets to record highs last week despite rising Covid-19 cases and larger-than-expected jobless claims. At week’s end the S&P 500 Index increased 2.3% to 3,638.35, the Nasdaq Composite Index increased 3.0% to 12,205.85, the 10-year U.S. Treasury rate rose 2bps to 85bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened another 0.7%.

Crude oil prices followed U.S. stock markets moving sharply higher early in the week supported by increased demand expectations resulting from positive Covid-19 vaccine news and on the back of news regarding a possible Janet Yellen nomination as treasury secretary. Wednesday’s unexpected decline in U.S. oil inventories and growing expectations OPEC+ would delay production increases at its upcoming Nov 30th meeting, helped push oil prices to 8-month highs at week’s end.

Precious metal prices fell last week decreasing with continued positive Covid-19 vaccine and prophylactic news despite a weaker U.S. dollar. Gold and silver prices finished the weak about 5% and 8% lower, respectively. Platinum prices performed better, falling less than 1%, possibly benefiting from increasing base metal prices.

Growing expectations of a faster-than-expected global economic recovery resulting from positive Covid-19 vaccine news combined with strong Chinese manufacturing data and falling mining production, helped move copper prices to multi-year highs last week with other base metal prices moving higher as well. A weaker U.S. dollar also supported base metal prices.

Grain prices rose last week benefiting from continued strong export demand, dry and hot weather concerns in the U.S and globally and positive Covid-19 vaccine news. Wheat prices were also supported by the USDA’s downgrading the percentage of the U.S. winter wheat crop in good to excellent condition.

Coffee prices pushed higher again last week benefiting again from concerns of La Nina-caused hot dry weather and a strengthening Brazilian real relative to the U.S. dollar.

Coming up this week

Another busy week with Fed Chairman Jerome Powell testifying before congress on Tuesday and Wednesday and the Employment Situation report on Friday.

Another busy week with Fed Chairman Jerome Powell testifying before congress on Tuesday and Wednesday and the Employment Situation report on Friday.- Chicago PMI and Pending Home Sales on Monday.

- PMI and ISM Manufacturing Indexes, Construction Spending, Jerome Powell speaking on Tuesday.

- ADP Employment Report and Jerome Powell speaking on Wednesday.

- Jobless Claims, PMI Composite Index, ISM Services Index and the Fed Balance Sheet on Thursday.

- EIA petroleum status report on Wednesday and Baker-Hughes rig count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.