Commoditized Wisdom: Report (Week Ending March 1, 2024)

Posted:

Key points

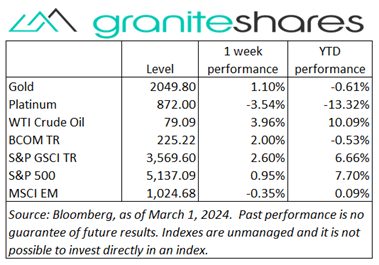

Oil, gasoline and heating oil prices rose 3% to 4% last week while natural gas prices increased 7%.

Oil, gasoline and heating oil prices rose 3% to 4% last week while natural gas prices increased 7%.- Grain prices were mixed with wheat prices down as much as 2%, corn prices higher by 3% and soybean prices up 1%.

- Spot gold prices gained 2% and spot silver prices rose 1%. Spot platinum and palladium prices fell 1%.

- Aluminum, zinc and nickel prices rose 1% to 3%. Copper prices lost 1% and lead prices fell 3%.

- The Bloomberg Commodity Index rose 2%. All sectors had gains but with the energy and precious metals sectors providing most of the gains.

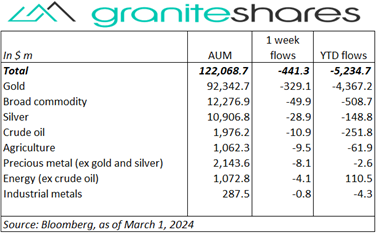

- Outflows again from each ETP category but primarily from gold ETPs.

Commentary

A week characterized by “bad news is good news” with weak economic data/news driving the Nasdaq Composite and S&P 500 Indexes to new highs. Weaker-than-expected consumer confidence, durable goods orders and manufacturing PMIs, higher-than-expected jobless claims and Q4 GDP downward revisions boosted expectations of June rate cuts, pushing longer-term Treasury rates lower and boosting rate-sensitive equity prices. Thursday’s as-expected PCE Price Index release served to alleviate inflation concerns precipitated by higher-than-expected CPI and PPI releases, also supporting markets. The Nasdaq Composite Index increased noticeably more than the S&P 500 Index and sharply outperformed the Dow Jones Industrial Average. 10-year Treasury rates, up 5bps, through Wednesday, ended the week 7bps lower. For the week, the S&P 500 Index gained 1.0% to 5,137.09, the Nasdaq Composite Index rose 1.7% to 16,274.94, the Dow Jones Industrial Average decreased 0.1% to 39,087.38, the 10-year U.S. Treasury rate fell 7bp to 4.18% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.1%.

A week characterized by “bad news is good news” with weak economic data/news driving the Nasdaq Composite and S&P 500 Indexes to new highs. Weaker-than-expected consumer confidence, durable goods orders and manufacturing PMIs, higher-than-expected jobless claims and Q4 GDP downward revisions boosted expectations of June rate cuts, pushing longer-term Treasury rates lower and boosting rate-sensitive equity prices. Thursday’s as-expected PCE Price Index release served to alleviate inflation concerns precipitated by higher-than-expected CPI and PPI releases, also supporting markets. The Nasdaq Composite Index increased noticeably more than the S&P 500 Index and sharply outperformed the Dow Jones Industrial Average. 10-year Treasury rates, up 5bps, through Wednesday, ended the week 7bps lower. For the week, the S&P 500 Index gained 1.0% to 5,137.09, the Nasdaq Composite Index rose 1.7% to 16,274.94, the Dow Jones Industrial Average decreased 0.1% to 39,087.38, the 10-year U.S. Treasury rate fell 7bp to 4.18% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.1%.

Oil prices moved higher last week bolstered by favorable inflation data in the U.S. and the euro zone and by supply concerns. Falling euro zone and as-expected U.S. inflation readings increased central bank rate cut expectations, supporting prices, as did growing expectations of the continuation of current OPEC+ production cutbacks. Red Sea tensions also supported prices.

Spot gold prices moved higher buoyed by the same factors moving equity markets higher. Weak economic data – including declining manufacturing activity, falling durable good orders and consumer confidence – combined with an as-expected PCE Price Index release helped move gold prices to close the week at a 2-month high. Geopolitical concerns (mainly Mideast tensions) also supported prices.

Declining Chinese manufacturing activity and more bad news from China’s property sector pushed copper prices lower last week (despite a slightly weaker dollar and increased expectations of a June Fed rate cut). Nickel, aluminum and zinc prices, however, moved higher, reacting to potential U.S. and EU Russia sanctions, a weaker dollar and, for Nickel, Indonesian production concerns.

Corn prices ended the week higher primarily do to short covering and position squaring in front of month end but also due to reports China was looking to purchase U.S. corn. Soybean prices also moved higher, supported primarily by higher soybean oil prices (due to rising crude oil prices) and overall good domestic demand. Wheat prices, lower on the week, continued to be hurt by cheap Russia and Ukraine export prices.

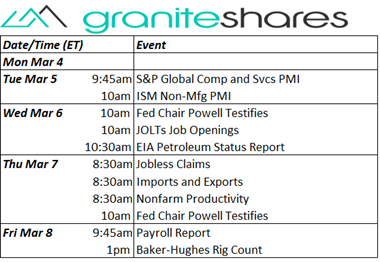

Coming Up This Week

Services and Composite PMI indexes, Fed Chair Powell testimony and Friday’s payroll report are the attention grabbers this week.

Services and Composite PMI indexes, Fed Chair Powell testimony and Friday’s payroll report are the attention grabbers this week.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.