Commoditized Wisdom: Report (Week Ending February 16, 2024)

Posted:

Key points

Energy prices were mixed. Oil prices rose 2%, gasoline prices were basically unchanged and heating oil prices fell 3%. Natural gas prices fell 9%.

Energy prices were mixed. Oil prices rose 2%, gasoline prices were basically unchanged and heating oil prices fell 3%. Natural gas prices fell 9%.- Grain prices again were all lower. Wheat prices fell 6%, corn prices dropped 3% and soybean prices decreased 1%.

- Spot gold prices decreased 1% while spot silver and platinum prices rose 4%. Palladium prices gained 11%.

- Base metal prices were all higher. Copper and zinc prices rose 4%, nickel prices gained 3% and lead prices increased 2%. Aluminum prices were unchanged.

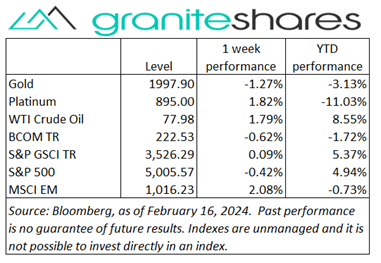

- The Bloomberg Commodity Index fell 0.6 %. Losses in the energy and grains sectors were partially offset by gains in the base and precious metals sectors.

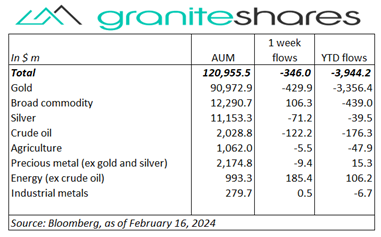

- Net outflows with outflows from gold, crude oil and silver ETPs and with inflows into broad commodity and energy (ex-crude oil) ETPs.

Commentary

Markets moved lower last week, this time with the Dow Jones Industrial Average noticeably outperforming the Nasdaq Composite Index. Tuesday’s higher-than-expected CPI release was the primary force pulling stock prices lower early last week. Prices rebounded Wednesday and Thursday, benefiting from both a weaker-than-expected retail sales report and a re-evaluation of the CPI release (i.e., CPI may have been higher due to certain one-time factors). Indexes, however, moved lower again on Friday following a higher-than-expected PPI release and despite a much weaker-than-expected housing starts report. 10-year Treasury rates, reflecting increasing higher-rates-for-longer expectations moved higher with increased inflation expectations accounting for about 70% of that move. For the week, the S&P 500 Index fell 0.4% to 5,005.57, the Nasdaq Composite Index dropped 1.3% to 15,775.65, the Dow Jones Industrial Average decreased 0.1% to 38,627.99, the 10-year U.S. Treasury rate rose 11bp to 4.29% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.2%.

Markets moved lower last week, this time with the Dow Jones Industrial Average noticeably outperforming the Nasdaq Composite Index. Tuesday’s higher-than-expected CPI release was the primary force pulling stock prices lower early last week. Prices rebounded Wednesday and Thursday, benefiting from both a weaker-than-expected retail sales report and a re-evaluation of the CPI release (i.e., CPI may have been higher due to certain one-time factors). Indexes, however, moved lower again on Friday following a higher-than-expected PPI release and despite a much weaker-than-expected housing starts report. 10-year Treasury rates, reflecting increasing higher-rates-for-longer expectations moved higher with increased inflation expectations accounting for about 70% of that move. For the week, the S&P 500 Index fell 0.4% to 5,005.57, the Nasdaq Composite Index dropped 1.3% to 15,775.65, the Dow Jones Industrial Average decreased 0.1% to 38,627.99, the 10-year U.S. Treasury rate rose 11bp to 4.29% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.2%.

Energy prices were mixed last week. Oil prices moved about 2% higher, bolstered mainly by Mideast and Red Sea/Houthi-related tensions, offsetting an unexpected sharp rise in inventories and higher rate/lower demand concerns precipitated by higher-than-expected CPI and PPI releases. Heating oil prices, however, affected by falling refinery runs and utilization rates, ended the week 3% lower while gasoline prices were basically unchanged. Natural gas prices, reeling from oversupply conditions and warm winter weather, fell a little over 9%.

Spot gold prices moved about ½ percent lower last week, reacting primarily to a higher-than-expected CPI release on Tuesday which pushed both the U.S. dollar and 10-year Treasury rates higher. Prices, however, moved higher the remainder of the week helped by haven demand, weaker-than-expected retail sales and housing starts reports and despite a higher-than-expected PPI release. Spot silver and platinum prices strongly outperformed gold prices, rising 4%, moving with base metal prices.

Copper and other base metal prices moved markedly higher last week, bolstered by falling inventory levels (copper) and growing expectations of additional Chinese stimulus. A stronger-than-expected official China PMI release also lent support to prices. Price moves were capped by a stronger-than-expected U.S. CPI release.

Grain prices were lower last week, led by a relatively sharp decline in wheat prices. Wheat prices suffered from lower prices globally prompted by growing production estimates in particular from Russia. Corn prices also suffered from growing production estimates both in the U.S and South America (along with improved weather forecasts for Argentina and Brazil). Soybean prices also moved lower (though fell the least), pressured by increased Argentina production forecasts and slow export sales.

Coming Up This Week

Light week centered on Wednesday’s FOMC minutes release.

Light week centered on Wednesday’s FOMC minutes release.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.