Commodities & Precious Metals Weekly Report: Jul 31

Posted:Key points

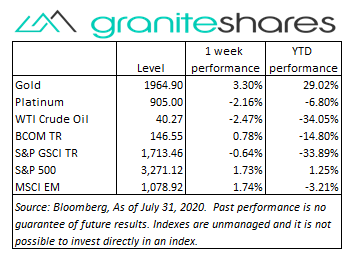

Energy prices were all lower last week. WTI and Brent crude oil prices fell 2.5% and 0.7%, respectively. Gasoil and heating oil prices decreased 2.3% and 3.2%, respectively and gasoline prices fell 6.8%. Natural gas prices declined 3.6%.

Energy prices were all lower last week. WTI and Brent crude oil prices fell 2.5% and 0.7%, respectively. Gasoil and heating oil prices decreased 2.3% and 3.2%, respectively and gasoline prices fell 6.8%. Natural gas prices declined 3.6%.- Grain prices were all lower as well with corn prices falling the most again. Chicago and Kansas wheat prices lost 1.5% and soybean prices fell 0.8%. Corn prices were down 3.1%.

- Sugar and coffee prices increased 10.0% and 9.7%, respectively.

- Similar to the previous week, base metal prices, except for copper prices, were all higher. Aluminum, zinc and nickel prices rose 0.5%, 4.5% and 0.9%, respectively. Copper prices fell 0.9%.

- Gold and silver prices rose last week while platinum prices fell. Gold prices increased 3.2% and silver prices increased 6.0%. Platinum prices decreased 2.2%.

- The Bloomberg Commodity Index increased again last week, increasing 0.78%. The precious metals and softs sectors were primarily response for the increase offset by negative performance in the energy and grains sectors.

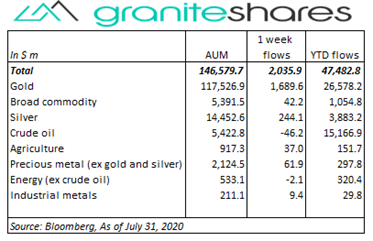

- Commodity ETP total assets continued to climb higher. Once again gold ETP inflows were primarily responsible and once again silver ETPs had respectable inflows. Inflows included gold ($1,689.6.m), silver ($244.1m), precious metal (ex-gold and silver) ($61.9m), broad commodity ($42.2m) and agriculture ($37.0m). Crude oil ETPs continued to lose assets, though at a slower rate, with $46.2m outflows.

Commentary

All three major U.S. stock indexes ended higher (moving in a zig-zag fashion), the U.S. dollar continued to weaken and the 10-year U.S Treasury rate fell last week as investors digested earnings and economic reports, FOMC statements, growing Covid-19 cases and congressional stimulus bill progress. Earnings reports, though generally mixed, provided strong support for U.S. stock markets with four major technology companies reporting better-than-expected results after the market on Thursday. Apple results were particularly strong, pushing the share price of Apple over 10% higher on Friday and raising its market capitalization to over $1.8 trillion. Comments by Fed Chairman Jerome Powell following the end of a 2-day FOMC meeting on Wednesday reaffirmed the Fed’s commitment to maintain aggressive monetary policy to support maximum employment and price stability. Chairman Powell also said the U.S. economy faces a long road to recovery, that the virus will determine the path of that recovery and emphasized the importance of fiscal policy to support the economy. Economic reports last week were also mixed with pending home sales, consumer spending and durable goods orders reports all better-than-expected while weekly jobless claims were slightly higher than expected. The first estimate of 2nd quarter GDP, released Thursday, posted its all-time greatest quarterly contraction of 32.9%, though this was slightly better than expectations. Markets also focused on Friday’s expiration of supplemental unemployment benefits and congressional negotiations to extend them and implement a phase 4 coronavirus stimulus package. At week’s end the S&P 500 Index increased 1.7% to 3,271.12, the Nasdaq Composite Index rose 3.7% to 10,745.27, the 10-year U.S. interest rate fell 6 bps to 53bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened another 1.2%.

All three major U.S. stock indexes ended higher (moving in a zig-zag fashion), the U.S. dollar continued to weaken and the 10-year U.S Treasury rate fell last week as investors digested earnings and economic reports, FOMC statements, growing Covid-19 cases and congressional stimulus bill progress. Earnings reports, though generally mixed, provided strong support for U.S. stock markets with four major technology companies reporting better-than-expected results after the market on Thursday. Apple results were particularly strong, pushing the share price of Apple over 10% higher on Friday and raising its market capitalization to over $1.8 trillion. Comments by Fed Chairman Jerome Powell following the end of a 2-day FOMC meeting on Wednesday reaffirmed the Fed’s commitment to maintain aggressive monetary policy to support maximum employment and price stability. Chairman Powell also said the U.S. economy faces a long road to recovery, that the virus will determine the path of that recovery and emphasized the importance of fiscal policy to support the economy. Economic reports last week were also mixed with pending home sales, consumer spending and durable goods orders reports all better-than-expected while weekly jobless claims were slightly higher than expected. The first estimate of 2nd quarter GDP, released Thursday, posted its all-time greatest quarterly contraction of 32.9%, though this was slightly better than expectations. Markets also focused on Friday’s expiration of supplemental unemployment benefits and congressional negotiations to extend them and implement a phase 4 coronavirus stimulus package. At week’s end the S&P 500 Index increased 1.7% to 3,271.12, the Nasdaq Composite Index rose 3.7% to 10,745.27, the 10-year U.S. interest rate fell 6 bps to 53bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened another 1.2%.

An up-and-down week for oil prices as well last week, with WTI crude oil prices finishing the week almost 2.5% lower. Down slightly through Tuesday, WTI crude oil prices rallied 1.4% on Wednesday after a much-larger-than-expected decline in U.S. oil inventories. These gains, however, were more than reversed on Thursday as coronavirus-related demand concerns resurfaced after a disappointing initial jobless claims number and the first estimate of 2nd quarter GDP posted its all-time greatest quarterly contraction. Natural gas prices up almost 4% through Wednesday on hotter-than-normal weather throughout most of the U.S. and Hurricane Isaias related production concerns, fell nearly 8% Thursday through Friday following the EIA reporting a much-larger-than-expected build in inventories and reduced concerns surrounding Hurricane Isaias. Gasoline prices suffered from not only increased coronavirus demand concerns, but also from a much-larger-than-expected build in gasoline inventories and reduced hurricane related production concerns as well.

After closing at a record high the previous Friday, gold prices never looked back, reaching new closing-level highs every day last week and closing at an all-time high of just under $1,965 per ounce. Increased geopolitical tensions, particularly between the U.S and China, President Trump’s tweet suggesting a need to delay elections, increased economic growth concerns stoked by a record quarterly contraction in U.S. GDP and a disappointing jobless claims number, Chairman Powell’s comments after last week’s FOMC meeting that the road to recovery will be long and dependent on the virus, congressional stimulus package negotiations and a weakening U.S. dollar all helped support and move gold prices higher.

All higher through Thursday, supported by a weakening dollar and expectations of increased demand, base metal prices fell on Friday following Thursday’s disappointing weekly jobless claims report and the resulting increased concerns regarding global economic recovery.

Corn and soybean prices moved lower last week, pressured by favorable weather conditions and increased expectations of record high harvest yields despite strong export sales and a weaker U.S. dollar. Wheat prices, down l.5% last week, moved lower on continued global oversupply concerns.

Coming up this week

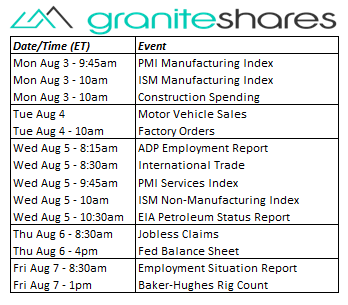

Another full data week with PMI and ISM manufacturing and services index releases and capped off with the employment situation report on Friday.

Another full data week with PMI and ISM manufacturing and services index releases and capped off with the employment situation report on Friday.- PMI and ISM manufacturing indexes and construction spending on Monday.

- Motor vehicle sales and factory orders on Tuesday.

- ADP employment report, international trade and PMI and ISM services indexes on Wednesday.

- Jobless claims and the Fed balance sheet on Thursday.

- Employment situation report on Friday.

- EIA petroleum report on Wednesday and Baker-Hughes rig count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.