Commodities & Precious Metals Weekly Report: Dec 29

Posted:

Key points

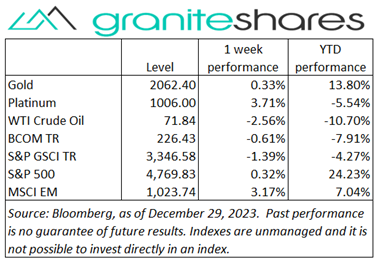

Energy prices were lower last week. WTI and Brent crude oil prices prices fell between 2% and 3%, heating oil and gasoil prices dropped 4% to 5% and gasoline prices decreased 2%. Natural gas prices moved ½ percent higher.

Energy prices were lower last week. WTI and Brent crude oil prices prices fell between 2% and 3%, heating oil and gasoil prices dropped 4% to 5% and gasoline prices decreased 2%. Natural gas prices moved ½ percent higher.- Grain prices were mixed. Wheat prices rose 2% to 3% and corn and soybean prices lost about ½ percent.

- Spot gold prices increased ½ percent and spot platinum prices gained 2%. Spot silver prices fell 2% and spot palladium prices dropped 8%.

- Base metal prices were mainly higher. Aluminum and zinc prices rose 2% and nickel and lead prices increased about ½ percent. copper prices fell less than ½ percent.

- The Bloomberg Commodity Index decreased 0.6%, primarily due to falling energy prices.

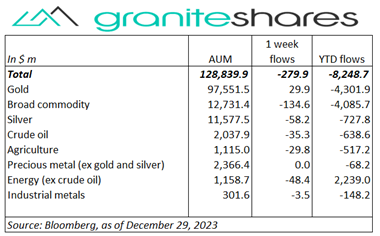

- Outflows from all sectors except for gold ETPs. Broad commodity, silver and energy ETPs comprised most of the outflows. Gold ETPs had small inflows.

Commentary

The 3 major stock indexes moved higher again last week, with the Dow Jones Industrial Average outperforming the Nasdaq Composite and S&P 500 Indexes. The gains came on no new news, with stock prices rising on continued hopes of next-year rate cuts amidst a “soft landing” scenario. On a YoY basis, the Nasdaq Composite Index strongly outpaced the other 2 indexes, increasing 43.4%. The S&P 500 Index rose 24.2% YoY, just failing to reach its record level set in January 2022, while the Dow Jones Industrial Average rose 13.7% YoY. Interestingly, on a 2-year basis the Dow Jones Industrial Average recorded the larger increase, gaining 3.7% over that period while the Nasdaq Composite Index registered a 4.1% loss over that same time frame. The S&P 500 Index edged slightly higher over the last 2 years, increasing 0.1%. For the week, the S&P 500 Index rose 0.3% to 4,769.83, the Nasdaq Composite Index gained 0.8% to 15,011.35, the Dow Jones Industrial Average increased 0.2% to 37,689.54, the 10-year U.S. Treasury rate fell 3bps to 3.87% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.3%.

The 3 major stock indexes moved higher again last week, with the Dow Jones Industrial Average outperforming the Nasdaq Composite and S&P 500 Indexes. The gains came on no new news, with stock prices rising on continued hopes of next-year rate cuts amidst a “soft landing” scenario. On a YoY basis, the Nasdaq Composite Index strongly outpaced the other 2 indexes, increasing 43.4%. The S&P 500 Index rose 24.2% YoY, just failing to reach its record level set in January 2022, while the Dow Jones Industrial Average rose 13.7% YoY. Interestingly, on a 2-year basis the Dow Jones Industrial Average recorded the larger increase, gaining 3.7% over that period while the Nasdaq Composite Index registered a 4.1% loss over that same time frame. The S&P 500 Index edged slightly higher over the last 2 years, increasing 0.1%. For the week, the S&P 500 Index rose 0.3% to 4,769.83, the Nasdaq Composite Index gained 0.8% to 15,011.35, the Dow Jones Industrial Average increased 0.2% to 37,689.54, the 10-year U.S. Treasury rate fell 3bps to 3.87% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.3%.

Higher Tuesday on a Houthi missile attack on a Red Sea tanker, oil prices moved lower the rest of the week as Red Sea concerns diminished and the U.S. dollar strengthened off its intraweek low. A much larger-than-expected oil inventory drawdown (as reported by the EIA on Thursday) initially moved prices higher but prices reversed lower after the drawdown was attributed to tax-related moves by refiners in the Gulf states region. The WTI futures price, roll adjusted, ended the year down almost 11%, its lowest level since 2020.

Spot gold prices moved higher last week supported by continued rate-cut expectations for early next year as well as slightly weaker-than-expected jobless claims. Spot prices finished off their intraweek highs, with prices moving lower on a strengthening U.S. dollar and holiday-related lethargy. Nonetheless, spot gold prices finished the year up over 13% and just below highs last set in August 2020. Platinum prices outperformed gold prices on the week, moving higher with base metal prices while palladium prices fell over 8% and silver prices dropped just under 2%.

Copper prices ended the week slightly lower coming off of intraweek highs reached Wednesday. Better-than-expected Chinese industrial profits pushed copper prices almost 2% higher Wednesday (reaching a 5-month high) but those gains were reversed the remainder of the weak on profit taking and due to a strengthening U.S. dollar. Aluminum prices climbed higher over the week on continued Guinea bauxite production concerns and low Chinese inventories.

A mixed week for grain prices. Wheat prices moved higher on the back of Black Sea shipping concerns and on the reopening of Mexico rail passes. Corn and soybean prices moved slightly lower pressured by improved Brazil and Argentina weather forecasts.

Coming Up This Week

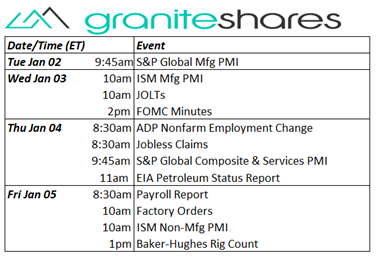

Busy week with ISM and S&P Global manufacturing and services index releases, FOMC minutes and Friday’s payroll reportabbing the headlines.

Busy week with ISM and S&P Global manufacturing and services index releases, FOMC minutes and Friday’s payroll reportabbing the headlines.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.