Commodities & Precious Metals Weekly Report: Feb 17

Posted:

Key points

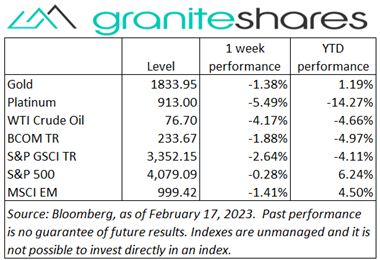

Energy prices were all lower last week. WTI crude oil Brent crude oil, gasoil and heating oil prices fell 4% while gasoline prices decreased 3%. Natural gas prices (May futures contract) dropped 10%.

Energy prices were all lower last week. WTI crude oil Brent crude oil, gasoil and heating oil prices fell 4% while gasoline prices decreased 3%. Natural gas prices (May futures contract) dropped 10%.- Grain prices were lower too. Chicago SRW prices fell 2.5%. Kansas City HRW and corn prices moved marginally lower and soybean prices fell 1%.

- Precious metal prices were lower, too. Spot gold and silver prices fell 1.2% and platinum prices lost 2.5%.

- Base metal prices were mixed. Nickel prices fell 7%, aluminum prices lost 2% and lead prices decreased 1%. Copper prices rose 2% and zinc prices gained 1%.

- The Bloomberg Commodity Index fell 1.9%. Losses came primarily from the energy sector with smaller losses from the grains and base and precious metals sectors.

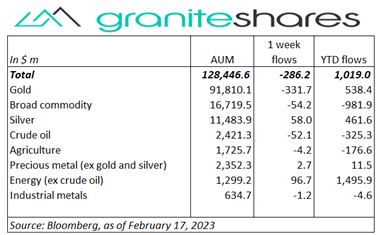

- Close to $300 million outflows from commodity ETPs last week primarily from gold ETPs. Broad commodity and crude oil ETPs had smaller outflows which were mostly offset by energy (ex-crude oil) inflows.

Commentary

A mixed week for major stock market indexes with market sentiment turning from risk-on to risk-off after digesting implications of higher-than-expected inflation readings and strong economic data. All three indexes were higher through Wednesday with the Nasdaq Composite Index leading the pack at up 3%. Initial optimism over cooling inflation combined with strong retail sales morphed into concerns of stubbornly-high inflation and a resilient economy leading to a more aggressive Fed raising rates to higher-than-expected levels for a longer-than-previously expected time. Thursday’s higher-than-expected PPI release along with hawkish Fed officials’ comments added to market malaise with index levels dropping markedly over Thursday and Friday. The Nasdaq Composite Index, though finishing the week higher, fell the most, decreasing just under 2.5% over the last 2 days of the week. The 10-year Treasury rate registered a moderate increase, climbing 8bps over the week with most of the increase due to rising 10-year real rates. The U.S. dollar experienced a somewhat volatile week but finished only slightly stronger. For the week, the S&P 500 Index decreased 0.3% to 4,079.09, the Nasdaq Composite Index increased 0.6% to 11,787.27 the Dow Jones Industrial Average edged slightly lower again, falling 0.1% to 33,862.92, the 10-year U.S. Treasury rate rose 8bp to 3.82% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.2%.

A mixed week for major stock market indexes with market sentiment turning from risk-on to risk-off after digesting implications of higher-than-expected inflation readings and strong economic data. All three indexes were higher through Wednesday with the Nasdaq Composite Index leading the pack at up 3%. Initial optimism over cooling inflation combined with strong retail sales morphed into concerns of stubbornly-high inflation and a resilient economy leading to a more aggressive Fed raising rates to higher-than-expected levels for a longer-than-previously expected time. Thursday’s higher-than-expected PPI release along with hawkish Fed officials’ comments added to market malaise with index levels dropping markedly over Thursday and Friday. The Nasdaq Composite Index, though finishing the week higher, fell the most, decreasing just under 2.5% over the last 2 days of the week. The 10-year Treasury rate registered a moderate increase, climbing 8bps over the week with most of the increase due to rising 10-year real rates. The U.S. dollar experienced a somewhat volatile week but finished only slightly stronger. For the week, the S&P 500 Index decreased 0.3% to 4,079.09, the Nasdaq Composite Index increased 0.6% to 11,787.27 the Dow Jones Industrial Average edged slightly lower again, falling 0.1% to 33,862.92, the 10-year U.S. Treasury rate rose 8bp to 3.82% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.2%.

Oil prices moved lower with excess-supply concerns combining with reduced-demand concerns pushing prices lower throughout the week. Monday, the only up day for oil prices, saw prices increase on announced Russian production cuts despite the reopening of Turkey’s oil port and expectations of record shale oil production. An outsized build in oil stocks (EIA report) was mainly discounted due to an EIA adjustment to oil inventories but nonetheless resulted in prices falling Wednesday and with the price decline coming even as the IEA forecasted higher 2023 demand growth. Conflicting economic data Thursday – higher-than-expected PPI and low initial jobless claims vs a sharply lower Phil. Fed Mfg Index – left prices almost unchanged. Prices, however, fell sharply Friday with investor concerns of a Fed-induced slowdown/recession reducing oil demand expectations. Natural gas prices were markedly lower last week, falling 10% on growing supply and moderate warm-weather demand.

Spot gold prices moved lower last week as well. Tuesday’s CPI release showing slowing inflation combined with Wednesday’s strong retail sales report revived concerns of higher rates with growing expectations the Fed would continue to tighten and leave rates higher longer than currently expected. Down 1.5% through Thursday, gold prices moved higher over the last 2 days of the week on increased safe-haven demand following decent stock market declines. Silver and platinum prices moved lower as well.

Another volatile week for copper prices buffered by hopes of increased Chinese demand versus central-bank induced demand attrition. Slightly lower through Wednesday (with prices falling markedly Wednesday due to a stronger U.S. dollar and Fed tightening concerns), prices rallied 2.5% Thursday on renewed signs and hopes of Chinese demand with copper prices ending the week 2% higher. Aluminum prices were lower 2% on the week, falling on continued inventory growth. Nickel prices dropped 7% last week, perhaps partially from the fallout of the fraud acted upon Trafigura. (Trafigura revealed it had received nearly 20,000 tons of “fake” nickel from purchases made in 2022. The rise in price through January may have been a result of Trafigura purchases to replace the “fake” metal it received.)

Grain prices were mixed last week. Chicago wheat prices fell almost 3%, pressured by significantly cheaper Russian and Ukrainian wheat prices as well as more favorable U.S. weather forecasts. Soybean prices, 1% lower on the week, fell despite continued drought conditions in Argentina and harvest difficulties in Brazil. Corn prices were practically unchanged.

Coming up this week

FOMC minutes Wednesday and PCE Price Index Friday dominate the week followed by GDP Thursday and home sales data Tuesday and Friday.

FOMC minutes Wednesday and PCE Price Index Friday dominate the week followed by GDP Thursday and home sales data Tuesday and Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.