Commodities & Precious Metals Weekly Report: Jan 6

Posted:

Key points

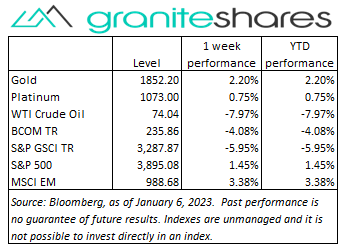

Energy prices were all sharply lower. WTI and Brent crude oil prices fell 8%. Heating oil prices also fell 8% and gasoline prices dropped 9%. Natural gas prices (March futures contract) plummeted 17%.

Energy prices were all sharply lower. WTI and Brent crude oil prices fell 8%. Heating oil prices also fell 8% and gasoline prices dropped 9%. Natural gas prices (March futures contract) plummeted 17%.- Grain prices were all lower as well. Wheat prices were down 6%, corn prices 4% and soybean prices 2%.

- Precious metal prices were mixed. Spot gold and platinum prices increased 2% percent. Spot silver prices decreased 1%.

- Base metal prices also were mixed. Aluminum and nickel prices fell 4% and 7%, respectively. Copper and zinc prices increased 3% and 2%, respectively.

- The Bloomberg Commodity Index fell 4.3%. 80% of the decline came from the energy sector with natural gas alone accounting for over 1/3 of the loss. The precious metals sector was the only sector with positive returns last week.

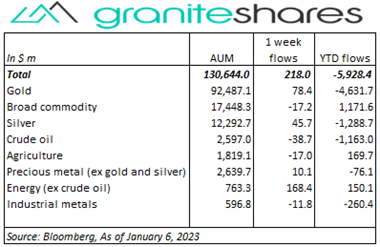

- Continued small net flows into commodity ETPs last week. Energy (ex-crude oil) ETPs received the greatest inflows followed by gold and silver ETPs.

Commentary

Stock prices trended lower through Thursday with concerns of continued aggressive Fed monetary policy for the most part controlling investor and market sentiment. Lower-than-expected initial jobless claims and a strong ADP release overrode weak PMI Manufacturing PMI and ISM Mfg Index releases (f ollowing the “good news is bad news” paradigm), pressuring all three major stock market indexes lower through Thursday. That all changed, however, following Friday’s job report which showed significantly reduced wage pressures and a weaker-than-expected ISM Services Index release. While the jobs report showed the number of jobs added declined from the previous month (and that the previous month’s increase was revised lower), it was the slowdown in hourly wages that caught the market’s attention. That slowdown, along with the weak ISM Services Index number, increased investor expectations of a less-aggressive Fed spurring a sharp stock market rally. In concert with those expectations, the 10-year U.S. Treasury rate, lower 15bps through Thursday, fell another 17bps Friday. At week’s end, the S&P 500 Index rose 1.4% to 3,895.08, the Nasdaq Composite Index increased 1.0% to 10,569.29, the Dow Jones Industrial Average gained 1.5% to close at 33,629.79, the 10-year U.S. Treasury rate fell 32bps to 3.56% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.4%.

Stock prices trended lower through Thursday with concerns of continued aggressive Fed monetary policy for the most part controlling investor and market sentiment. Lower-than-expected initial jobless claims and a strong ADP release overrode weak PMI Manufacturing PMI and ISM Mfg Index releases (f ollowing the “good news is bad news” paradigm), pressuring all three major stock market indexes lower through Thursday. That all changed, however, following Friday’s job report which showed significantly reduced wage pressures and a weaker-than-expected ISM Services Index release. While the jobs report showed the number of jobs added declined from the previous month (and that the previous month’s increase was revised lower), it was the slowdown in hourly wages that caught the market’s attention. That slowdown, along with the weak ISM Services Index number, increased investor expectations of a less-aggressive Fed spurring a sharp stock market rally. In concert with those expectations, the 10-year U.S. Treasury rate, lower 15bps through Thursday, fell another 17bps Friday. At week’s end, the S&P 500 Index rose 1.4% to 3,895.08, the Nasdaq Composite Index increased 1.0% to 10,569.29, the Dow Jones Industrial Average gained 1.5% to close at 33,629.79, the 10-year U.S. Treasury rate fell 32bps to 3.56% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.4%.

Oil prices fell sharply Monday and Tuesday with WTI crude oil prices down over almost 9.5% over the 2-day period. Recession (demand) fears combined with contracting U.S. and China business activity were the primary reasons for the pronounced decline. Increased OPEC oil production also added to lower price pressures. Oil prices moved higher Thursday following an EIA report showing distillate inventory fell much more than expected and as a result of a U.S. pipeline shutdown for unscheduled maintenance. Friday’s job report, while bolstering U.S. stock markets, seemingly had little effect on oil prices despite the U.S. dollar weakening by 1%. Natural gas prices continued their run lower, falling over 17% on warmer-than-usual U.S. weather forecasts through mid-January.

Gold prices rose last week, increasing every day but Thursday as expectations increased the Fed may need to lower rates sooner than expected. Contracting U.S. manufacturing and services activity as shown by Manufacturing PMI released Tuesday and the ISM Manufacturing Index released Wednesday supported expectations of a more benign Fed moving forward. While Thursday’s lower-than-expected initial jobless claims number weakened those expectations (pushing gold prices lower), Friday’s job report showing weakening wage pressures, revived those expectations propelling gold prices almost 2% higher. Silver prices, up over 2.5% Friday, ended the week down about ½ percent. Platinum prices performed similarly to gold prices.

Pressured by weakening business activity in the U.S and China and by China growth concerns due to surging Covid cases, base metal prices moved lower through Wednesday. Copper prices, down almost 2% through Wednesday, rallied sharply the remainder of the week buoyed by reports of Chinese government support and investment in its property and manufacturing areas. Base metal prices were also supported by a weakening U.S. dollar Friday, precipitated by a U.S. jobs report showing markedly reduced wage growth.

Grain prices were all lower last week with wheat prices falling the most. Prices, for the most part, fell every day but Friday. Soybean and corn prices suffered from improved Argentina weather conditions, expectations of large Brazil crops and concerns of weak Chinese demand. Sharply lower oil prices reduced bean oil and ethanol demand, also pushing prices lower. Wheat prices primarily suffered from aggressive Russian pricing (and thus sales) motivated by record crop levels. Reports of fund selling may have also hurt grain prices.

Coming up this week

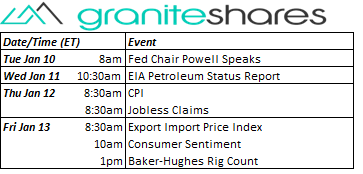

Though uncluttered and relatively quiet week, Fed Chair Jerome Powell speaks Tuesday and the markets anxiously await Thursday’s CPI release.

Though uncluttered and relatively quiet week, Fed Chair Jerome Powell speaks Tuesday and the markets anxiously await Thursday’s CPI release.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.