Commodities & Precious Metals Weekly Report: May 12

Posted:

Key points

Energy prices were mainly lower. Brent and WTI crude oil prices fell 2%, heating oil prices lost 1% and gasoil prices were unchanged. Gasoline prices rose 2% and natural gas prices gained 5%.

Energy prices were mainly lower. Brent and WTI crude oil prices fell 2%, heating oil prices lost 1% and gasoil prices were unchanged. Gasoline prices rose 2% and natural gas prices gained 5%.- Grain prices, too, were mainly lower. Chicago wheat prices fell 4%, corn prices lost 2% and soybean prices gave up 3%. Kansas City wheat prices rose 5%.

- Spot gold and platinum prices decreased about ¼ percent and spot silver prices dropped 7%. Palladium prices increased 1%.

- Base metal prices were all lower. Copper and aluminum prices fell 4%, zinc prices dropped 5% and nickel prices lost 10%. Lead prices decreased 2%.

- The Bloomberg Commodity Index decreased 1.6%. Base and precious metals and grains sector losses were the primary reason for the decline.

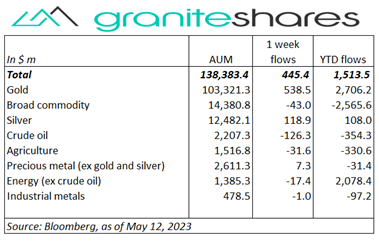

- More net inflows into commodity ETPs mainly from inflows into gold and silver ETPs with outflows from crude oil, agriculture and broad commodity ETPs.

Commentary

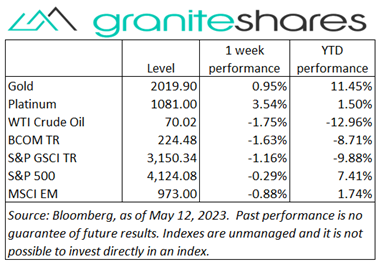

Indexes were mixed last week with the Nasdaq Composite Index realizing a small gain and both the S&P 500 Index and Dow Jones Industrial Average ending the week lower. Prior to Wednesday’s CPI release, stock markets generally moved lower on tightening credit conditions resulting from regional bank issues and uncertainty regarding future Fed monetary policy. A slightly better-than-expected CPI release moved stock prices higher on growing expectations the Fed would not only pause rate hikes but also would be more likely to ease later this year. And while Thursday’s PPI release added to that sentiment, recession concerns re-emerged on the back of renewed regional bank concerns (PacWest’s share price fell 23% after reporting it continued to see deposit outflows) and higher-than-expected initial jobless claims, pressuring stock markets lower or, in the case of the Nasdaq Composite Index, limiting gains. Friday’s University of Michigan Consumer Sentiment Survey added to stock market woes, showing long-term inflation expectations rose to levels not seen since 2011, greatly reducing expectations of the Fed easing this year and pushing all 3 major stock indexes lower on the day. The 10-year Treasury rate, buffeted by changing Fed expectations, evolving regional bank concerns and uncertainty regarding economic growth, ended the week only slightly higher. For the week, the S&P 500 Index decreased 0.3% to 4,124.08, the Nasdaq Composite Index rose 0.4% to 12,284.71, the Dow Jones Industrial Average fell 1.1% to 33,300.62, the 10-year U.S. Treasury rate increased 3bps to 3.46% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 1.5%.

Indexes were mixed last week with the Nasdaq Composite Index realizing a small gain and both the S&P 500 Index and Dow Jones Industrial Average ending the week lower. Prior to Wednesday’s CPI release, stock markets generally moved lower on tightening credit conditions resulting from regional bank issues and uncertainty regarding future Fed monetary policy. A slightly better-than-expected CPI release moved stock prices higher on growing expectations the Fed would not only pause rate hikes but also would be more likely to ease later this year. And while Thursday’s PPI release added to that sentiment, recession concerns re-emerged on the back of renewed regional bank concerns (PacWest’s share price fell 23% after reporting it continued to see deposit outflows) and higher-than-expected initial jobless claims, pressuring stock markets lower or, in the case of the Nasdaq Composite Index, limiting gains. Friday’s University of Michigan Consumer Sentiment Survey added to stock market woes, showing long-term inflation expectations rose to levels not seen since 2011, greatly reducing expectations of the Fed easing this year and pushing all 3 major stock indexes lower on the day. The 10-year Treasury rate, buffeted by changing Fed expectations, evolving regional bank concerns and uncertainty regarding economic growth, ended the week only slightly higher. For the week, the S&P 500 Index decreased 0.3% to 4,124.08, the Nasdaq Composite Index rose 0.4% to 12,284.71, the Dow Jones Industrial Average fell 1.1% to 33,300.62, the 10-year U.S. Treasury rate increased 3bps to 3.46% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 1.5%.

Oil prices moved higher early last week, climbing on reduced recession fears (following the previous Friday’s strong employment report) and diminished U.S banking system concerns. The Biden Administration announcement it could begin replenishing the Strategic Petroleum Reserve later this year along with Canadian wildfires restricting a significant percentage of its production also supported prices. Prices, however, fell sharply the remainder of the week precipitated by an unexpected increase in U.S. oil inventories (from Wednesday’s EIA report) and then compounded by weak U.S. and Chinese economic data and mounting U.S. banking system and debt ceiling concerns. Natural gas prices, unchanged through Thursday, rallied Friday on a sharp decline in operating natural gas rigs as reported by the Baker-Hughes Rig Count report.

Spot gold prices also moved higher early in the week, climbing just under 1% through Tuesday on U.S. banking and recession concerns. Tighter credit conditions, as reported by the Fed, increased expectations the Fed would be more likely to ease this year also supported prices. Despite Wednesday’s slightly better-than-expected CPI release, expectations of the Fed easing later this year fell with sentiment influenced by the stubbornly high level of inflation. Friday’s University of Michigan Consumer Sentiment Report showing rising inflation expectations added to this sentiment, driving Treasury rates and the dollar higher while pushing gold prices lower.

Initially higher on falling China inventory levels, copper prices fell the remainder of the week suffering from weak Chinese and U.S. economic data, decreased expectations regarding Fed easing and increased concerns surrounding the U.S. banking system and U.S. debt ceiling. Other base metal prices performed similarly with nickel prices underperforming (down almost 10% on the week) and lead prices outperforming (down 2% on the week).

A mostly down week for grain prices with the exception of Kansas City HRW wheat prices which ended the week up over 5%. Grain prices moved lower through Thursday, influenced mainly by favorable weather/weather forecasts and weak exports. Friday’s USDA WASDE report showing much lower-than-expected U.S. wheat production and supply (particularly for Kansas City HRW wheat), moved wheat prices sharply higher. Despite bearish WASDE numbers, corn prices rose slightly Friday perhaps lifted by strong wheat prices. Soybean prices, however, fell over 1% Friday with the WASDE report showing greater-than-expected ending stocks and larger-than-expected Brazil production.

Coming Up This Week

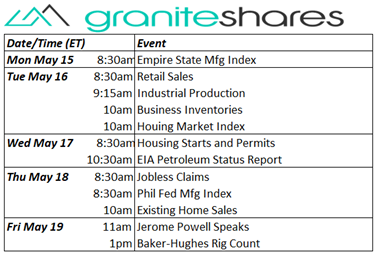

- Ret

ail Sales, Housing Starts and Permits, Existing Homes Sales and the Phil. Fed and Empire State Manufacturing Indexes are the focal points this week. Fed Chair Jerome Powell speaks Friday as well.

ail Sales, Housing Starts and Permits, Existing Homes Sales and the Phil. Fed and Empire State Manufacturing Indexes are the focal points this week. Fed Chair Jerome Powell speaks Friday as well.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.