Commodities & Precious Metals Weekly Report: Jul 17

Posted:Key points

Energy prices were all lower last week with natural gas and gasoline prices falling the most. WTI crude oil prices again were unchanged while Brent crude oil prices decreased 0.3%. Gasoil and heating oil prices fell 0.8% and 1.7%, respectively. Gasoline and natural gas prices fell 4.2% and 4.4%, respectively.

Energy prices were all lower last week with natural gas and gasoline prices falling the most. WTI crude oil prices again were unchanged while Brent crude oil prices decreased 0.3%. Gasoil and heating oil prices fell 0.8% and 1.7%, respectively. Gasoline and natural gas prices fell 4.2% and 4.4%, respectively.- Grain prices were mixed last week. Chicago wheat prices increased slightly, gaining 0.1% while Kansas wheat prices fell 0.7%. Corn prices lost 1.3% and soybean prices rose 0.5%.

- Base metal prices, except for copper prices, were all lower. Aluminum, zinc and nickel prices fell 1.7%, 0.5% and 2.2%, respectively. Copper prices increased 0.2%.

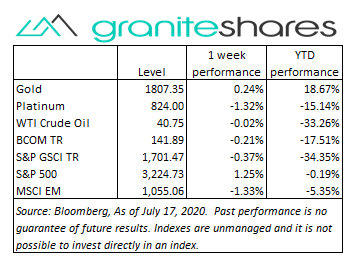

- Gold and silver prices increased last week with gold prices increasing 0.2% and silver prices increasing 3.7%. Platinum prices fell 1.3%.

- The Bloomberg Commodity Index moved slightly lower, decreasing 0.21%. The energy and base metals sectors were responsible for the decrease. All other sectors had positive performance over the week.

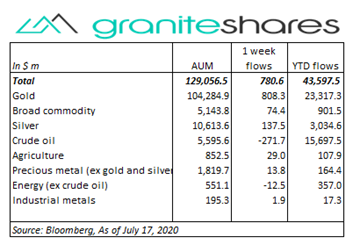

- Total assets in commodity ETPs once again rose, adding $780.6m last week. And once again, gold ($808.3m) ETP inflows were the greatest followed by - also like the previous week - silver ($137.5m) and broad commodity ($74.4m) inflows with smaller inflows into agriculture and precious metals (ex-gold and silver) ETPs. Crude oil (-$271.7m) ETP outflows continued last week with no other significant ETP outflows.

Commentary

U.S. stock markets continued to struggle with concerns over increasing U.S. Covid-19 cases versus strong economic reports and hopeful news regarding development of a Covid-19 vaccine. Covid-19 concerns - sharpened by Carlifornia reopening rollbacks - and anxiety surrounding earnings reports for major bank and tech stocks pushed U.S. stock markets lower on Monday, with the Nasdaq Compositie Index significantly underperforming the S&P 500 Index. Those losses were more than reversed on Tuesday and Wednesday after better-than-expected earnings releases from JPMorgan, Goldman Sachs and Morgan Stanley, positive Covid-19 vaccine news from 3 pharmaceutical/biotech companies, higher-than-expected CPI and stronger-than-expected industrial production reports. A much-larger-than expected increase in retail sales on Thursday was offset by continued high jobless claims with U.S. Stock markets mainly unchanged the remainder of the week. At week’s end the S&P 500 Index increased 1.3% to close at 3,224.73, the Nasdaq Composite Index fell 1.1% to 10,503.19, the 10-year U.S. interest rate fell 1 bp to 63bps and the U.S. dollar (as measured by the U.S. Dollar index - DXY) weakened another 0.7%.

U.S. stock markets continued to struggle with concerns over increasing U.S. Covid-19 cases versus strong economic reports and hopeful news regarding development of a Covid-19 vaccine. Covid-19 concerns - sharpened by Carlifornia reopening rollbacks - and anxiety surrounding earnings reports for major bank and tech stocks pushed U.S. stock markets lower on Monday, with the Nasdaq Compositie Index significantly underperforming the S&P 500 Index. Those losses were more than reversed on Tuesday and Wednesday after better-than-expected earnings releases from JPMorgan, Goldman Sachs and Morgan Stanley, positive Covid-19 vaccine news from 3 pharmaceutical/biotech companies, higher-than-expected CPI and stronger-than-expected industrial production reports. A much-larger-than expected increase in retail sales on Thursday was offset by continued high jobless claims with U.S. Stock markets mainly unchanged the remainder of the week. At week’s end the S&P 500 Index increased 1.3% to close at 3,224.73, the Nasdaq Composite Index fell 1.1% to 10,503.19, the 10-year U.S. interest rate fell 1 bp to 63bps and the U.S. dollar (as measured by the U.S. Dollar index - DXY) weakened another 0.7%.

Climbing to a 4-month high on Wednesday following a much-larger-than-expected decline in U.S. oil inventories, WTI prices moved lower after an OPEC+ decision to reduce production cutbacks beginning in August and due to increasing demand concerns as a result of growing Covid-19 cases in the U.S. and elsewhere. Up 1.5% through Wednesday, WTI prices finished the week unchanged.

Copper prices, up 2% on Monday on concerns of coronavirus- and strike-related mining disruptions in Chile and extremely strong China imports, gave up almost all their gains over the remainder of the week with coronavirus-related demand concerns and increasing U.S. – China frictions surrounding Hong Kong. Other base metal prices, suffering from little or no supply worries, fell more sharply on demand concerns.

Gold prices, higher early in the week on increasing concerns over growing Covid-19 cases and California’s reimposition of restrictions, moved lower the rest of the week to finish only slightly higher following positive Covid-19 vaccine news and better-than-expected U.S. economic news. Silver prices, up almost 4% on the week, benefited from increased demand and undersupply conditions. Platinum prices moved lower with base metal prices

Down over 3% through Wednesday due to oversupply concerns, corn prices rose almost 2% the remainder of the week mainly on news of increased China buying. Soybean prices, too, benefited from Friday’s news of China buying, finishing the week up 0.5% after being down almost 1% through Wednesday.

Coming up this week

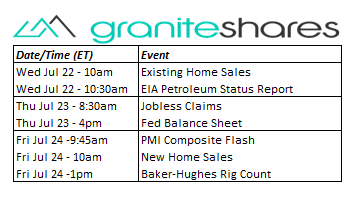

Very light economic-data week with no significant reports until Wednesday, though a busy week for earnings reports.

Very light economic-data week with no significant reports until Wednesday, though a busy week for earnings reports.- Existing home sales on Wednesday.

- Jobless claims and Fed balance sheet on Thursday.

- PMI Composite flash and new home sales on Friday.

- EIA petroleum report on Wednesday and Baker-Hughes rig count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.