Researches By Investment cases

NVIDIA Corporation, a global leader in graphics processing units (GPUs) and artificial intelligence (AI) technology, is set to announce its first-quarter earnings, a highly anticipated event in the tech sector. As a powerhouse in the semiconductor industry, NVIDIA's performance often serves as a barometer for the broader market, influencing investor sentiment and industry trends.

Topic: Equity , Leveraged Single Stocks

Publication Type: Investment Cases , Articles

What to Know Ahead of NVIDIA's Q1 Earnings

21 May, 2024 | GraniteShares

NVIDIA Corporation, a global leader in graphics processing units (GPUs) and artificial intelligence (AI) technology, is set to announce its first-quarter earnings, a highly anticipated event in the tech sector. As a powerhouse in the semiconductor industry, NVIDIA's performance often serves as a barometer for the broader market, influencing investor sentiment and industry trends.

Gold is often though of as a hedge against inflation. With inflation reaching 40-year highs, some analysts may have expected gold to perform well. However, after a strong start of the year, mostly attributed to its role as safe-haven asset at the start of the Ukrainian war, the gold price retreated to its pre-covid 19 level. As of November 08, 2022, the price of gold is down 6.4% year to date (source Bloomberg).

Topic: Gold

Publication Type: Investment Cases

Gold Market Sentiments for the Entire Year

21 November, 2022 | GraniteShares

Gold is often though of as a hedge against inflation. With inflation reaching 40-year highs, some analysts may have expected gold to perform well. However, after a strong start of the year, mostly attributed to its role as safe-haven asset at the start of the Ukrainian war, the gold price retreated to its pre-covid 19 level. As of November 08, 2022, the price of gold is down 6.4% year to date (source Bloomberg).

The unfortunate reality is that a deep chasm stands between investor income requirements and what conventional strategies can now yield. Alternative Income may help bridge the divide.

Topic: Income

Publication Type: Investment Cases

Income Blueprint: HIPS Income Replacement

13 October, 2020 | GraniteShares

The unfortunate reality is that a deep chasm stands between investor income requirements and what conventional strategies can now yield. Alternative Income may help bridge the divide.

Platinum is one of the rarest metals found on our planet. It’s a hard, silvery metal discovered in 1735, thousands of years after gold due to its high melting point it is rarely found in its pure form.Formed millions of years ago, platinum occurs at very low concentrations deep in the Earth’s crust and is about 30 times rarer than gold. It is interesting to note that all of the platinum ever mined would only come up to your ankles in an Olympic swimming pool, whereas all the gold produced would fill more than three.

Topic: Commodities

Publication Type: Investment Cases

PLATINUM AN INVESTMENT CASE

16 September, 2020 | GraniteShares

Platinum is one of the rarest metals found on our planet. It’s a hard, silvery metal discovered in 1735, thousands of years after gold due to its high melting point it is rarely found in its pure form.Formed millions of years ago, platinum occurs at very low concentrations deep in the Earth’s crust and is about 30 times rarer than gold. It is interesting to note that all of the platinum ever mined would only come up to your ankles in an Olympic swimming pool, whereas all the gold produced would fill more than three.

Income is one of the most basic, yet important needs of any portfolio—the capacity to generate enduring cashflows to fund expenses. While searching for sustainable yield is never easy, over the last decade income investing become a most unpalatable cocktail — one part frustration and two parts despair (add bitters to taste). These were the difficulties that pervaded income investing before COVID-19 struck, an economic shock that redoubled the income challenge to near unimaginable levels.

Topic: Income

Publication Type: Investment Cases

Crafting Your Income Blueprint: Strategies with HIPS

10 September, 2020 | GraniteShares

Income is one of the most basic, yet important needs of any portfolio—the capacity to generate enduring cashflows to fund expenses. While searching for sustainable yield is never easy, over the last decade income investing become a most unpalatable cocktail — one part frustration and two parts despair (add bitters to taste). These were the difficulties that pervaded income investing before COVID-19 struck, an economic shock that redoubled the income challenge to near unimaginable levels.

The current economic tumult recatalyzes the classic, three-fold case for gold, namely asset stability, diversification and vulnerability of the dollar in the new Fed paradigm. This investment case explores the critical dynamics that have propelled gold to new record highs above $2,000/oz, and how the asset's unique status combining characteristics of a commodity and a currency lend gold unique value as the global economy attempts a reset from the COVID-19 tumult.

Topic: Gold

Publication Type: Investment Cases

Gold's Investment Case: New Record Highs

03 September, 2020 | GraniteShares

The current economic tumult recatalyzes the classic, three-fold case for gold, namely asset stability, diversification and vulnerability of the dollar in the new Fed paradigm. This investment case explores the critical dynamics that have propelled gold to new record highs above $2,000/oz, and how the asset's unique status combining characteristics of a commodity and a currency lend gold unique value as the global economy attempts a reset from the COVID-19 tumult.

For decades, the 60/40 portfolio—comprising 60% stocks and 40% bonds—has been the cornerstone of traditional investment strategies. It offers a balanced approach, with stocks providing growth potential and bonds acting as a stabilizing force through income generation and reduced volatility. This mix has historically delivered reliable, risk-adjusted returns, making it a go-to strategy for long-term investors seeking growth while managing downside risk.

Topic: Gold

Publication Type: Investment Cases

Sharpe Up Your Portfolio: Enhancing 60/40 with Gold

02 September, 2020 | GraniteShares

For decades, the 60/40 portfolio—comprising 60% stocks and 40% bonds—has been the cornerstone of traditional investment strategies. It offers a balanced approach, with stocks providing growth potential and bonds acting as a stabilizing force through income generation and reduced volatility. This mix has historically delivered reliable, risk-adjusted returns, making it a go-to strategy for long-term investors seeking growth while managing downside risk.

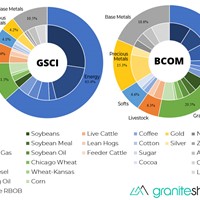

BCI vs GSCI which index is the right choice as either an investment or benchmark? Unlike stocks and bonds, commodities do not lend themselves to indexing in an immediately intuitive fashion. Read more on the relative importance, perspective, and purpose of commodities.

Topic: Gold , Commodities

Publication Type: Investment Cases

Will the Real Commodities Index Please Stand Up?

01 September, 2020 | GraniteShares

BCI vs GSCI which index is the right choice as either an investment or benchmark? Unlike stocks and bonds, commodities do not lend themselves to indexing in an immediately intuitive fashion. Read more on the relative importance, perspective, and purpose of commodities.

When no company or industry is immune from disruptive challenge, perhaps never has the number of potential losers been so plentiful, nor the disparity between winners and losers been so vast. Rather than succumb to conventional wisdom, perhaps the only thing more important than what you put IN your portfolio is what you XOUT.

Topic: XOUT

Publication Type: Investment Cases

How Many Losers Are in the S&P 500?

17 August, 2020 | GraniteShares

When no company or industry is immune from disruptive challenge, perhaps never has the number of potential losers been so plentiful, nor the disparity between winners and losers been so vast. Rather than succumb to conventional wisdom, perhaps the only thing more important than what you put IN your portfolio is what you XOUT.

In a world of exotic assets and fast trading, what has become of the world’s oldest asset, gold? Modern finance, where the pursuit of endless sophistication is often confused with success itself, has forced investors to ask a pivotal question: is gold obsolete?

Topic: Gold

Publication Type: Investment Cases

Outlook for Gold? A New Take on the Oldest Asset

28 March, 2020 | GraniteShares

In a world of exotic assets and fast trading, what has become of the world’s oldest asset, gold? Modern finance, where the pursuit of endless sophistication is often confused with success itself, has forced investors to ask a pivotal question: is gold obsolete?

While diversification may be one of the most common refrains in finance, the irony is that it is home to widespread misconceptions among investors, both novice and seasoned alike. Everyone intuitively understands the wisdom of “don’t place all your eggs in one basket” – such logic extends to everyday life – but investors often find themselves with far fewer “baskets” than they even realize.

What factors account for this discrepancy in diversification?

Topic: Gold

Publication Type: Investment Cases

Correlations And The Art of A Terrible Tango

28 March, 2020 | GraniteShares

While diversification may be one of the most common refrains in finance, the irony is that it is home to widespread misconceptions among investors, both novice and seasoned alike. Everyone intuitively understands the wisdom of “don’t place all your eggs in one basket” – such logic extends to everyday life – but investors often find themselves with far fewer “baskets” than they even realize.

What factors account for this discrepancy in diversification?

Thirty times rarer than gold, platinum occurs at very low concentrations in the Earth’s crust. There are only four countries in the world that have platinum mining operations of any significance and of these South Africa has the largest platinum resources by far.

Topic: Commodities

Publication Type: Investment Cases

Where Does Platinum Come From?

28 March, 2020 | GraniteShares

Thirty times rarer than gold, platinum occurs at very low concentrations in the Earth’s crust. There are only four countries in the world that have platinum mining operations of any significance and of these South Africa has the largest platinum resources by far.

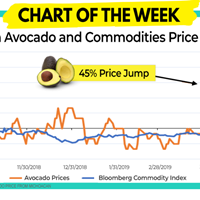

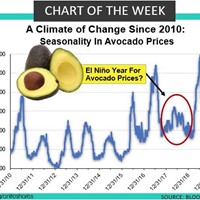

Just when you thought it was safe to buy guacamole again, Avocado prices surge 45%! Millennial purchasing power may never recover…

Topic: Commodities , Alternative Income

Publication Type: Investment Cases

Millennial Avocados- Chart of the Week

28 March, 2020 | GraniteShares

Just when you thought it was safe to buy guacamole again, Avocado prices surge 45%! Millennial purchasing power may never recover…

Mental accounting is a truly defining feature of the human condition. Find out how much of your income is mental, and how it may prevent you from acheiving your true income goals.

Topic: Alternative Income

Publication Type: Investment Cases

Overcoming Investing Fallacies, GraniteShares Perspective

27 March, 2020 | GraniteShares

Mental accounting is a truly defining feature of the human condition. Find out how much of your income is mental, and how it may prevent you from acheiving your true income goals.

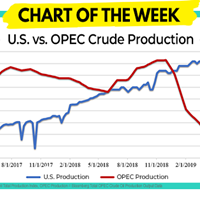

Playing dirty? Recent OPEC production cuts are as large as total U.S. growth over the past 2 years…

Topic: Commodities , Alternative Income

Publication Type: Investment Cases

U.S. vs. OPEC Crude Production – Chart of the Week

27 March, 2020 | GraniteShares

Playing dirty? Recent OPEC production cuts are as large as total U.S. growth over the past 2 years…

Recent changes to the Chinese government’s New Energy Vehicle program have shifted the focus away from the subsidies awarded to battery electric vehicles towards FCEV roll-out and, importantly, the development of the country’s hydrogen refueling infrastructure.

Topic: Commodities

Publication Type: Investment Cases

Fuel Cell Electric Vehicles in China

27 March, 2020 | GraniteShares

Recent changes to the Chinese government’s New Energy Vehicle program have shifted the focus away from the subsidies awarded to battery electric vehicles towards FCEV roll-out and, importantly, the development of the country’s hydrogen refueling infrastructure.

It is the wedding band on your ring finger. It is with you every time you’re travelling by car, three grams at least. This is the story of platinum, a metal that follows us and underlies our lives in subtle, yet profound ways.

Topic: Commodities

Publication Type: Investment Cases

You May Know Gold, but Do You Know Platinum?

27 March, 2020 | GraniteShares

It is the wedding band on your ring finger. It is with you every time you’re travelling by car, three grams at least. This is the story of platinum, a metal that follows us and underlies our lives in subtle, yet profound ways.

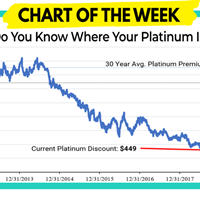

Historically, platinum has been known as the “Rich Man’s Gold,” trading at an average premium to gold of $132 over the last 30 years. Will the current $449 discount to gold ever revert to the long-term average?

Topic: Commodities

Publication Type: Investment Cases

Do You Know Where Your Platinum Is? – Chart of the Week

27 March, 2020 | GraniteShares

Historically, platinum has been known as the “Rich Man’s Gold,” trading at an average premium to gold of $132 over the last 30 years. Will the current $449 discount to gold ever revert to the long-term average?

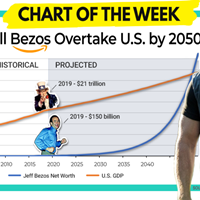

Chart of the week from Ryan Giannotto…. At current rate, will Jeff Bezos’ wealth surpass the GDP of the US? It could happen in ~30 years.

Topic: Commodities , Alternative Income

Publication Type: Investment Cases

Will Bezos Overtake U.S. by 2050? – Chart of the Week

27 March, 2020 | GraniteShares

Chart of the week from Ryan Giannotto…. At current rate, will Jeff Bezos’ wealth surpass the GDP of the US? It could happen in ~30 years.

If you thought achieving income yields was difficult, life will only get harder—the Fed that giveth can taketh away. Just as investors were getting accustomed to the taste of at least modestly non-zero rates, expectations have shifted swiftly.

Topic: Alternative Income

Publication Type: Investment Cases

Help! What Happened to My Income?

27 March, 2020 | GraniteShares

If you thought achieving income yields was difficult, life will only get harder—the Fed that giveth can taketh away. Just as investors were getting accustomed to the taste of at least modestly non-zero rates, expectations have shifted swiftly.

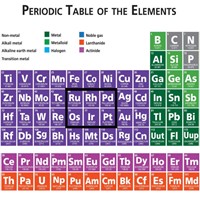

The Platinum Group Metals (PGMs) – platinum, palladium, rhodium, ruthenium, iridium and osmium – are a family of six individual elements that are chemically, physically and anatomically similar. They have unique properties and are used in many industrial processes – making, for example, auto-components, electronics, fertilizer and glass – as well as in medical treatments.

Topic: Commodities

Publication Type: Investment Cases

Platinum Metals: A Lightbulb Moment

27 March, 2020 | GraniteShares

The Platinum Group Metals (PGMs) – platinum, palladium, rhodium, ruthenium, iridium and osmium – are a family of six individual elements that are chemically, physically and anatomically similar. They have unique properties and are used in many industrial processes – making, for example, auto-components, electronics, fertilizer and glass – as well as in medical treatments.

Over the last year, gold has outperformed the S&P 500. Between Powell, a weaker dollar, and geopolitical tensions, will gold break out of its 6-year hibernation?

Topic: Gold

Publication Type: Investment Cases

Is Gold Out of 6 Year Rut? – Chart of the Week

27 March, 2020 | GraniteShares

Over the last year, gold has outperformed the S&P 500. Between Powell, a weaker dollar, and geopolitical tensions, will gold break out of its 6-year hibernation?

While generating sustainable yield for income investing has never been an easy task, the latest shockwaves to reverberate through interest rate markets have only compounded this challenge. The core of this problem for investors, whether retirees, long-term savers, or anyone looking to diversify their returns, is they are probably looking for yield in all the wrong places.

Topic: Income

Publication Type: Investment Cases

Seeking Yield: Finding 7% Income in Today’s Market

27 March, 2020 | GraniteShares

While generating sustainable yield for income investing has never been an easy task, the latest shockwaves to reverberate through interest rate markets have only compounded this challenge. The core of this problem for investors, whether retirees, long-term savers, or anyone looking to diversify their returns, is they are probably looking for yield in all the wrong places.

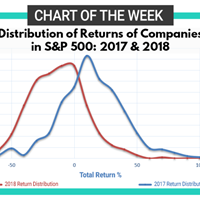

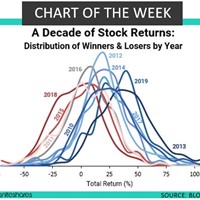

Chart of the week from Ryan Giannotto…. A classic case for diversification? Investors had 5 times the chance of picking a stock in the S&P 500 with a 30% or greater loss in 2018 vs. 2017.

Topic: Commodities , Alternative Income

Publication Type: Investment Cases

Diversify, Diversify, Diversify – Chart of the Week

27 March, 2020 | GraniteShares

Chart of the week from Ryan Giannotto…. A classic case for diversification? Investors had 5 times the chance of picking a stock in the S&P 500 with a 30% or greater loss in 2018 vs. 2017.

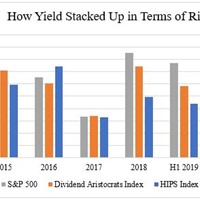

In the shifting sands of today’s market, finding sustainable income may be one the most challenging, yet pervasive concerns for investors. More troubling yet, market watchers may think they are positioned in income or dividend-oriented strategies, only to realize these approaches may deliver only marginally more income than the broad market.

Topic: Alternative Income

Publication Type: Investment Cases

Are You Actually Set up for Income?

27 March, 2020 | GraniteShares

In the shifting sands of today’s market, finding sustainable income may be one the most challenging, yet pervasive concerns for investors. More troubling yet, market watchers may think they are positioned in income or dividend-oriented strategies, only to realize these approaches may deliver only marginally more income than the broad market.

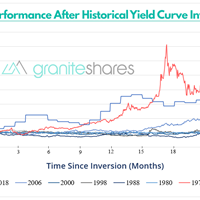

2019 has introduced myriad new varieties of yield to investors, including familiar fan-favorites such as flat and declining yields. For investors seeking a more exotic flare, markets have debuted negative and even inverted yields. However, only true aficionados will be able to savor the ultimate pairing of yield flavors, such as negative speculative yields, a true Italian masterpiece. Ciao Bella!

Topic: Alternative Income

Publication Type: Investment Cases

31 Flavors of Yield

27 March, 2020 | GraniteShares

2019 has introduced myriad new varieties of yield to investors, including familiar fan-favorites such as flat and declining yields. For investors seeking a more exotic flare, markets have debuted negative and even inverted yields. However, only true aficionados will be able to savor the ultimate pairing of yield flavors, such as negative speculative yields, a true Italian masterpiece. Ciao Bella!

GraniteShares is an independent, fully funded ETF company headquartered in New York City. GraniteShares’ ETF suite includes one of the lowest-cost physical gold ETFs (BAR), a broad-based commodity ETF (COMB), an ETF that seeks to exclude U.S. large cap companies most likely to suffer from technological disruption over the long term (XOUT), a high alternative income-focused fund that invests in pass-through securities (HIPS) and the lowest-cost* physical platinum ETF (PLTM). GraniteShares has experienced robust growth in 2019, recently surpassing $700 million in total assets under management.

Topic: Income

Publication Type: Investment Cases

GraniteShares Announces Change in ETF Lineup

27 March, 2020 | GraniteShares

GraniteShares is an independent, fully funded ETF company headquartered in New York City. GraniteShares’ ETF suite includes one of the lowest-cost physical gold ETFs (BAR), a broad-based commodity ETF (COMB), an ETF that seeks to exclude U.S. large cap companies most likely to suffer from technological disruption over the long term (XOUT), a high alternative income-focused fund that invests in pass-through securities (HIPS) and the lowest-cost* physical platinum ETF (PLTM). GraniteShares has experienced robust growth in 2019, recently surpassing $700 million in total assets under management.

In a world of exotic assets and fast trading, what has become of the world’s oldest asset, gold? Here are 3 compelling reasons to consider gold, the original FinTech.

Topic: Gold

Publication Type: Investment Cases

3 Reasons For Gold

27 March, 2020 | GraniteShares

In a world of exotic assets and fast trading, what has become of the world’s oldest asset, gold? Here are 3 compelling reasons to consider gold, the original FinTech.

How powerful is disruption? If the original 1980 Toyota Camry followed Moore’s Law, its 94 horsepower engine would have exceeded a semi-truck’s by 1986, surpassed a tank’s by ’88, outpaced the largest container ship’s by 2001, outclassed a nuclear reactor by ’08, and finally eclipse space shuttle’s power by 2019, growing to over 47 million hp!

Publication Type: Investment Cases

Just How Powerful is Disruption? Chart of the Week

27 March, 2020 | GraniteShares

How powerful is disruption? If the original 1980 Toyota Camry followed Moore’s Law, its 94 horsepower engine would have exceeded a semi-truck’s by 1986, surpassed a tank’s by ’88, outpaced the largest container ship’s by 2001, outclassed a nuclear reactor by ’08, and finally eclipse space shuttle’s power by 2019, growing to over 47 million hp!

Stock market returns come in all shapes and size—how exactly does 2019’s 30% gain measure up? Breaking down a decade of S&P 500 stocks illustrates how lumpy equity returns can be, and the folly to simply trying pick winners. Just as important as the actual returns is how they are distributed, and this chart serves as a powerful visualization of how the risks we take are always changing.

Topic: Gold

Publication Type: Investment Cases

A Decade of Stock Returns: Chart of the Week

27 March, 2020 | GraniteShares

Stock market returns come in all shapes and size—how exactly does 2019’s 30% gain measure up? Breaking down a decade of S&P 500 stocks illustrates how lumpy equity returns can be, and the folly to simply trying pick winners. Just as important as the actual returns is how they are distributed, and this chart serves as a powerful visualization of how the risks we take are always changing.

Climate intersects with investing on many levels- look no further than to agricultural commodities. Examining seasonal avocado prices is just one example of how changes in climate may be increasingly interconnected with investing: a confluence of science, economics and ethics.

Topic: Commodities , Alternative Income

Publication Type: Investment Cases

Climate and Avocado Prices: Chart of the Week

26 March, 2020 | GraniteShares

Climate intersects with investing on many levels- look no further than to agricultural commodities. Examining seasonal avocado prices is just one example of how changes in climate may be increasingly interconnected with investing: a confluence of science, economics and ethics.

One of the prime rationales for a gold allocation is introducing an uncorrelated driver of returns to stock and bond exposures, two fundamental building blocks for most standard portfolios. The challenge is, for many investors the search for diversifying assets begins and ends with gold, when there exists an entire ecosystem of precious metals just over the horizon.

Topic: Gold , Commodities

Publication Type: Investment Cases

Madness in the Metals: What Will 2020 Bring?

26 March, 2020 | GraniteShares

One of the prime rationales for a gold allocation is introducing an uncorrelated driver of returns to stock and bond exposures, two fundamental building blocks for most standard portfolios. The challenge is, for many investors the search for diversifying assets begins and ends with gold, when there exists an entire ecosystem of precious metals just over the horizon.

Platinum-based sensors have widespread applications, improving our personal safety, enhancing the functionality of equipment and processes, as well as paving the way for future technologies.

Topic: Commodities

Publication Type: Investment Cases

Sensory Perception with Platinum

19 March, 2019 | GraniteShares

Platinum-based sensors have widespread applications, improving our personal safety, enhancing the functionality of equipment and processes, as well as paving the way for future technologies.

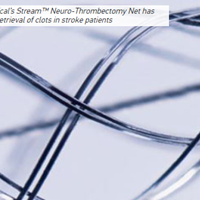

Innovation in the treatment of patients with neurovascular conditions is harnessing platinum’s radiopacity – clear visibility in X-rays – allowing doctors greater precision and achieving better outcomes.

Topic: Commodities

Publication Type: Investment Cases

X-Ray Vision? How Platinum Helps

12 March, 2019 | GraniteShares

Innovation in the treatment of patients with neurovascular conditions is harnessing platinum’s radiopacity – clear visibility in X-rays – allowing doctors greater precision and achieving better outcomes.

The modern periodic table was first created 150 years ago, enabling the classification of chemical elements for the first

time, including the Platinum Group Metals.

Topic: Commodities

Publication Type: Investment Cases

Platinum and 150 Years of the Periodic Table

26 February, 2019 | GraniteShares

The modern periodic table was first created 150 years ago, enabling the classification of chemical elements for the first

time, including the Platinum Group Metals.

Commodities fuel the world’s economy. Raw materials like copper or crude oil are essential for industrial processes in all sectors of all markets, from Buffalo to Beijing. As such, commodities offer a unique opportunity to invest in economic growth at its most elemental level.

Topic: Commodities , Alternative Income

Publication Type: Investment Cases

Commodities: Why Now? An Investment Case

12 November, 2018 | GraniteShares

Commodities fuel the world’s economy. Raw materials like copper or crude oil are essential for industrial processes in all sectors of all markets, from Buffalo to Beijing. As such, commodities offer a unique opportunity to invest in economic growth at its most elemental level.