Researches By Comb

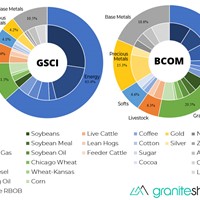

Commodities are one of the oldest asset classes in the financial markets, offering investors a way to diversify their portfolios beyond traditional stocks and bonds. Commodities refer to raw materials and primary agricultural products that are traded in global markets, such as oil, gold, wheat, and natural gas.

How to Invest in Commodities

18 March, 2025 | GraniteShares

Commodities are one of the oldest asset classes in the financial markets, offering investors a way to diversify their portfolios beyond traditional stocks and bonds. Commodities refer to raw materials and primary agricultural products that are traded in global markets, such as oil, gold, wheat, and natural gas.

There may be no bigger winner from the U.S. presidential election cycle than Elon Musk. His rise from innovative thinker to social media king to presidential advisor has completely reinvigorated Tesla’s stock. At the beginning of the year, Tesla was essentially flat on the year. Now, it’s nearing a gain of 100% year-to-date1.

Is the Elon Musk Super Influencer Rally Sustainable

14 January, 2025 | GraniteShares

There may be no bigger winner from the U.S. presidential election cycle than Elon Musk. His rise from innovative thinker to social media king to presidential advisor has completely reinvigorated Tesla’s stock. At the beginning of the year, Tesla was essentially flat on the year. Now, it’s nearing a gain of 100% year-to-date1.

GraniteShares – Fund Distributions – December 2024

Topic: Technology , Leveraged Single Stocks , YieldBOOST

Publication Type: Market Commentaries

GraniteShares – Fund Distributions – December 2024

27 December, 2024 | GraniteShares

GraniteShares – Fund Distributions – December 2024

Oil prices moved markedly lower suffering from a much larger-than-expected build in U.S. inventories, larger-than-expected increase in gasoline inventories, declining heating oil demand and growing U.S. production. Diminished Mideast tensions also contributed to lower prices while Friday’s weaker-than-expected payroll report seemed to have little effect on prices.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending May 3, 2024)

06 May, 2024 | Jeff Klearman

Oil prices moved markedly lower suffering from a much larger-than-expected build in U.S. inventories, larger-than-expected increase in gasoline inventories, declining heating oil demand and growing U.S. production. Diminished Mideast tensions also contributed to lower prices while Friday’s weaker-than-expected payroll report seemed to have little effect on prices.

Grain prices moved higher with wheat prices increasing the most. Wheat prices benefited from European frost damage to crops, adverse Ukraine and Russia weather forecasts and on Russia attacks on Ukraine grain infrastructure. Prices also benefited from adverse weather forecasts for Southwestern Plains states. Corn and soybean prices moved higher with wheat prices and benefited, to some extent, from a stronger Brazilian real relative to the U.S. dollar.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending April 26, 2024)

26 April, 2024 | Jeff Klearman

Grain prices moved higher with wheat prices increasing the most. Wheat prices benefited from European frost damage to crops, adverse Ukraine and Russia weather forecasts and on Russia attacks on Ukraine grain infrastructure. Prices also benefited from adverse weather forecasts for Southwestern Plains states. Corn and soybean prices moved higher with wheat prices and benefited, to some extent, from a stronger Brazilian real relative to the U.S. dollar.

Copper and other base metal prices moved sharply higher last week, buoyed by U.S. and UK sanctions on Russian metals (the sanctions prevent delivery of Russian metal to the LME), increased expectations of a copper deficit and signs of China economic growth. Aluminum and nickel prices, directly affected by the U.S. and UK sanctions, increased the most, followed by copper prices.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending April 19, 2024)

22 April, 2024 | Jeff Klearman

Copper and other base metal prices moved sharply higher last week, buoyed by U.S. and UK sanctions on Russian metals (the sanctions prevent delivery of Russian metal to the LME), increased expectations of a copper deficit and signs of China economic growth. Aluminum and nickel prices, directly affected by the U.S. and UK sanctions, increased the most, followed by copper prices.

Copper prices moved higher again last week finding support from a resilient U.S. economy, stronger-than-expected German industrial production and hopes of growing Chinese demand amidst production cutbacks. Price gains, however, were capped by a significantly stronger U.S. dollar resulting from lowered U.S. rate-cut expectations.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending April 12, 2024)

15 April, 2024 | Jeff Klearman

Copper prices moved higher again last week finding support from a resilient U.S. economy, stronger-than-expected German industrial production and hopes of growing Chinese demand amidst production cutbacks. Price gains, however, were capped by a significantly stronger U.S. dollar resulting from lowered U.S. rate-cut expectations.

Spot gold prices moved markedly higher last week, buoyed by central bank and haven demand (resulting primarily from Increased Israel-Iran tensions and the ongoing Ukraine-Russia conflict) and despite increased uncertainty regarding Fed rate cuts following hawkish fed officials’ comments and strong U.S. economic data.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending April 5, 2024)

08 April, 2024 | Jeff Klearman

Spot gold prices moved markedly higher last week, buoyed by central bank and haven demand (resulting primarily from Increased Israel-Iran tensions and the ongoing Ukraine-Russia conflict) and despite increased uncertainty regarding Fed rate cuts following hawkish fed officials’ comments and strong U.S. economic data.

Crude oil prices moved higher last week, bolstered by Russia production cutbacks, Ukraine drone attacks on Russian oil refineries and economic data pointing to a resilient U.S. economy. An unexpected rise in oil and gasoline inventories as reported by the EIA sent prices lower Wednesday, capping the weekly increase. Gasoline prices were practically unchanged and heating prices finished slightly lower on the week. Natural gas prices, down almost 6% through Wednesday on oversupply concerns, rallied almost 3% Thursday on a larger-than-expected drop in storage levels.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending March 28, 2024)

01 April, 2024 | Jeff Klearman

Crude oil prices moved higher last week, bolstered by Russia production cutbacks, Ukraine drone attacks on Russian oil refineries and economic data pointing to a resilient U.S. economy. An unexpected rise in oil and gasoline inventories as reported by the EIA sent prices lower Wednesday, capping the weekly increase. Gasoline prices were practically unchanged and heating prices finished slightly lower on the week. Natural gas prices, down almost 6% through Wednesday on oversupply concerns, rallied almost 3% Thursday on a larger-than-expected drop in storage levels.

Spot gold prices moved noticeably higher early last week, jumping almost 1.5% higher Wednesday following an as-expected FOMC rate decision along with dovish Fed Chair Powell comments and a better-than-expected dot plot release. Price gains reversed over Thursday and Friday on a stronger U.S. dollar and perhaps on profit taking. Silver and platinum prices moved lower moving more in step with base metal prices.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending March 22, 2024)

25 March, 2024 | Jeff Klearman

Spot gold prices moved noticeably higher early last week, jumping almost 1.5% higher Wednesday following an as-expected FOMC rate decision along with dovish Fed Chair Powell comments and a better-than-expected dot plot release. Price gains reversed over Thursday and Friday on a stronger U.S. dollar and perhaps on profit taking. Silver and platinum prices moved lower moving more in step with base metal prices.

Buoyed by increased IEA demand forecasts and Ukraine drone attacks on Russian refineries, crude oil prices moved 4% higher last week. Increased U.S refinery utilization rates and a surprise fall in U.S. oil inventories also contributed to the gain. Last week’s gain comes despite a noticeably stronger U.S. dollar.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending March 15, 2024)

18 March, 2024 | Jeff Klearman

Buoyed by increased IEA demand forecasts and Ukraine drone attacks on Russian refineries, crude oil prices moved 4% higher last week. Increased U.S refinery utilization rates and a surprise fall in U.S. oil inventories also contributed to the gain. Last week’s gain comes despite a noticeably stronger U.S. dollar.

Spot gold prices powered higher again last week driven by growing expectations of rate cuts as soon as June and by continued haven demand. Prices rose every day last week, at first in expectation of favorable Fed Chair Powell testimony and then following Powell testimony that the Fed will likely be in a position to lower rates soon. Friday’s employment report showing slowing wage growth and a higher unemployment rate also helped gold prices move higher.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending March 8, 2024)

11 March, 2024 | Jeff Klearman

Spot gold prices powered higher again last week driven by growing expectations of rate cuts as soon as June and by continued haven demand. Prices rose every day last week, at first in expectation of favorable Fed Chair Powell testimony and then following Powell testimony that the Fed will likely be in a position to lower rates soon. Friday’s employment report showing slowing wage growth and a higher unemployment rate also helped gold prices move higher.

Declining Chinese manufacturing activity and more bad news from China’s property sector pushed copper prices lower last week (despite a slightly weaker dollar and increased expectations of a June Fed rate cut). Nickel, aluminum and zinc prices, however, moved higher, reacting to potential U.S. and EU Russia sanctions, a weaker dollar and, for Nickel, Indonesian production concerns.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending March 1, 2024)

04 March, 2024 | Jeff Klearman

Declining Chinese manufacturing activity and more bad news from China’s property sector pushed copper prices lower last week (despite a slightly weaker dollar and increased expectations of a June Fed rate cut). Nickel, aluminum and zinc prices, however, moved higher, reacting to potential U.S. and EU Russia sanctions, a weaker dollar and, for Nickel, Indonesian production concerns.

Spot gold prices moved higher last week despite hawkish FOMC minutes and Fed officials’ comments. Haven buying, predicated on Mideast tensions, helped buoy gold prices but so did a weaker U.S. dollar and lower 10-year Treasury rates. The U.S. dollar weakened despite reduced expectations of “sooner-than-later” rate cuts, perhaps on profit taking. Spot silver and platinum prices moved lower, giving up some of last week’s noticeable gains.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending February 23, 2024)

26 February, 2024 | Jeff Klearman

Spot gold prices moved higher last week despite hawkish FOMC minutes and Fed officials’ comments. Haven buying, predicated on Mideast tensions, helped buoy gold prices but so did a weaker U.S. dollar and lower 10-year Treasury rates. The U.S. dollar weakened despite reduced expectations of “sooner-than-later” rate cuts, perhaps on profit taking. Spot silver and platinum prices moved lower, giving up some of last week’s noticeable gains.

Energy prices were mixed last week. Oil prices moved about 2% higher, bolstered mainly by Mideast and Red Sea/Houthi-related tensions, offsetting an unexpected sharp rise in inventories and higher rate/lower demand concerns precipitated by higher-than-expected CPI and PPI releases. Heating oil prices, however, affected by falling refinery runs and utilization rates, ended the week 3% lower while gasoline prices were basically unchanged. Natural gas prices, reeling from oversupply conditions and warm winter weather, fell a little over 9%.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending February 16, 2024)

20 February, 2024 | Jeff Klearman

Energy prices were mixed last week. Oil prices moved about 2% higher, bolstered mainly by Mideast and Red Sea/Houthi-related tensions, offsetting an unexpected sharp rise in inventories and higher rate/lower demand concerns precipitated by higher-than-expected CPI and PPI releases. Heating oil prices, however, affected by falling refinery runs and utilization rates, ended the week 3% lower while gasoline prices were basically unchanged. Natural gas prices, reeling from oversupply conditions and warm winter weather, fell a little over 9%.

Oil prices moved sharply higher last week, bolstered by Mideast and Ukraine/Russia tensions and falling fuel stocks. U.S. reprisal strikes in Mideast, Houthi Red Sea shipping attacks, Ukraine drone attacks on Russian refineries and lowered Israel/Hamas ceasefire expectations combined to jolt oil prices higher. Adding to upward price pressures was a much greater-than-expected fall in fuel inventories and the EIA substantively lowering its 2024 oil production forecast. Natural gas prices moved sharply lower in reaction to the Biden’s administration moratorium on new LNG production/facilities.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending February 9, 2024)

12 February, 2024 | Jeff Klearman

Oil prices moved sharply higher last week, bolstered by Mideast and Ukraine/Russia tensions and falling fuel stocks. U.S. reprisal strikes in Mideast, Houthi Red Sea shipping attacks, Ukraine drone attacks on Russian refineries and lowered Israel/Hamas ceasefire expectations combined to jolt oil prices higher. Adding to upward price pressures was a much greater-than-expected fall in fuel inventories and the EIA substantively lowering its 2024 oil production forecast. Natural gas prices moved sharply lower in reaction to the Biden’s administration moratorium on new LNG production/facilities.

Spot gold prices moved higher last week, benefiting primarily from haven buying. Increased Mideast tension in general and the deaths of 3 U.S. soldiers in particular increased gold haven demand, pushing prices higher during the week. Wednesday’s hawkish Powell comments following an as-expected rate decision, acting to pressure prices lower, was offset by renewed regional bank concerns precipitated by New York Community Bank’s unexpected Q4 loss. A larger-than-expected increase in Thursday’s jobless claims bolstered prices while Friday’s much stronger-than-expected payroll report, moving 10-year Treasury rates and the U.S. dollar higher, dragged prices lower. Silver and platinum prices, lower on the week, moved with base metal prices.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending February 2, 2024)

05 February, 2024 | Jeff Klearman

Spot gold prices moved higher last week, benefiting primarily from haven buying. Increased Mideast tension in general and the deaths of 3 U.S. soldiers in particular increased gold haven demand, pushing prices higher during the week. Wednesday’s hawkish Powell comments following an as-expected rate decision, acting to pressure prices lower, was offset by renewed regional bank concerns precipitated by New York Community Bank’s unexpected Q4 loss. A larger-than-expected increase in Thursday’s jobless claims bolstered prices while Friday’s much stronger-than-expected payroll report, moving 10-year Treasury rates and the U.S. dollar higher, dragged prices lower. Silver and platinum prices, lower on the week, moved with base metal prices.

Oil prices moved sharply higher last week, bolstered by Red Sea related tensions, supportive economic data and Chinese stimulus measures. Prices also were supported by a Ukrainian attack on a Russian fuel terminal, continued cold-weather related U.S. production disruptions and a larger-than-expected drawdown in U.S. oil inventories. Lower-than-expected inflation offset a better-than-expected Q1 GDP release (in the U.S.) while an as-expected ECB rate decision accompanied by dovish ECB Pres. Lagarde comments also contributed to oil price gains.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending January 26, 2024)

29 January, 2024 | Jeff Klearman

Oil prices moved sharply higher last week, bolstered by Red Sea related tensions, supportive economic data and Chinese stimulus measures. Prices also were supported by a Ukrainian attack on a Russian fuel terminal, continued cold-weather related U.S. production disruptions and a larger-than-expected drawdown in U.S. oil inventories. Lower-than-expected inflation offset a better-than-expected Q1 GDP release (in the U.S.) while an as-expected ECB rate decision accompanied by dovish ECB Pres. Lagarde comments also contributed to oil price gains.

Spot gold prices moved lower last week, affected by diminished expectations of Fed rate cuts this year. A better-than-expected retails sales report, lower-than-expected initial jobless claims and hawkish Fed officials’ comments throughout the week, worked to pressure prices lower. Prices partially recovered Thursday and Friday, spurred by safe-haven buying related to Red Sea/Houthi events. Silver prices underperformed gold prices while platinum prices, also lower, outperformed gold prices.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jan 19

22 January, 2024 | Jeff Klearman

Spot gold prices moved lower last week, affected by diminished expectations of Fed rate cuts this year. A better-than-expected retails sales report, lower-than-expected initial jobless claims and hawkish Fed officials’ comments throughout the week, worked to pressure prices lower. Prices partially recovered Thursday and Friday, spurred by safe-haven buying related to Red Sea/Houthi events. Silver prices underperformed gold prices while platinum prices, also lower, outperformed gold prices.

Another volatile week with oil prices finishing about 1% lower. Oil prices moved sharply lower Monday, reacting to increased supplies from some OPEC producers as well as other non-OPEC producers. Prices moved higher Tuesday on increased Red Sea tensions but then fell sharply Wednesday after a surprise large build in U.S. inventories and on increased euro zone demand concerns. Thursday and Friday saw prices rise, bolstered by U.S. extreme cold weather forecasts, U.S. and British attacks on Houthi (Yemen) military sites and on Iran’s seizure of a freighter.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending January 12, 2024)

16 January, 2024 | Jeff Klearman

Another volatile week with oil prices finishing about 1% lower. Oil prices moved sharply lower Monday, reacting to increased supplies from some OPEC producers as well as other non-OPEC producers. Prices moved higher Tuesday on increased Red Sea tensions but then fell sharply Wednesday after a surprise large build in U.S. inventories and on increased euro zone demand concerns. Thursday and Friday saw prices rise, bolstered by U.S. extreme cold weather forecasts, U.S. and British attacks on Houthi (Yemen) military sites and on Iran’s seizure of a freighter.

Spot gold prices fell last week pushed lower by renewed concerns the Fed may not ease as quickly or as much as expected. Wednesday’s FOMC Minutes release drove prices almost 1% lower with minutes revealing uncertainty with regard to rate cuts. Despite lower-than-expected jobless claims and a better-than-expected payroll report, gold prices rose with markets revisiting FOMC minutes and noting a weaker-than-expected ISM Services PMI release, somewhat reducing Fed rate-cut uncertainty.

Topic: Commodities

Publication Type: Market Commentaries

Commoditized Wisdom: Report (Week Ending January 5, 2025)

08 January, 2024 | Jeff Klearman

Spot gold prices fell last week pushed lower by renewed concerns the Fed may not ease as quickly or as much as expected. Wednesday’s FOMC Minutes release drove prices almost 1% lower with minutes revealing uncertainty with regard to rate cuts. Despite lower-than-expected jobless claims and a better-than-expected payroll report, gold prices rose with markets revisiting FOMC minutes and noting a weaker-than-expected ISM Services PMI release, somewhat reducing Fed rate-cut uncertainty.

Spot gold prices moved higher last week supported by continued rate-cut expectations for early next year as well as slightly weaker-than-expected jobless claims. Spot prices finished off their intraweek highs, with prices moving lower on a strengthening U.S. dollar and holiday-related lethargy. Nonetheless, spot gold prices finished the year up over 13% and just below highs last set in August 2020. Platinum prices outperformed gold prices on the week, moving higher with base metal prices while palladium prices fell over 8% and silver prices dropped just under 2%.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Dec 29

02 January, 2024 | Jeff Klearman

Spot gold prices moved higher last week supported by continued rate-cut expectations for early next year as well as slightly weaker-than-expected jobless claims. Spot prices finished off their intraweek highs, with prices moving lower on a strengthening U.S. dollar and holiday-related lethargy. Nonetheless, spot gold prices finished the year up over 13% and just below highs last set in August 2020. Platinum prices outperformed gold prices on the week, moving higher with base metal prices while palladium prices fell over 8% and silver prices dropped just under 2%.

Gold prices moved lockstep to stock prices, rising early in the week, retracting Wednesday, and then rising the remainder of the week. Underlying forces were similar as well, with continued Fed rate-cut, cooling inflation and resilient economy expectations responsible for price gains early in the week. Doubts of those same expectations moved prices lower Wednesday only to see them rebound and more Thursday and Friday following a revised-lower Q3 GDP and a better-than-expected PCE Price Index release. Silver prices moved with gold prices while platinum prices outperformed.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Dec 22

26 December, 2023 | Jeff Klearman

Gold prices moved lockstep to stock prices, rising early in the week, retracting Wednesday, and then rising the remainder of the week. Underlying forces were similar as well, with continued Fed rate-cut, cooling inflation and resilient economy expectations responsible for price gains early in the week. Doubts of those same expectations moved prices lower Wednesday only to see them rebound and more Thursday and Friday following a revised-lower Q3 GDP and a better-than-expected PCE Price Index release. Silver prices moved with gold prices while platinum prices outperformed.

Gold prices performed similarly to oil prices, falling early in the week and then recouping all and more of those losses the remainder. Future Fed policy doubts, in front of Wednesday’s FOMC announcement, pushed gold prices markedly lower Tuesday after a somewhat lackluster CPI release. Wednesday’s dovish comments accompanying an as-expected FOMC rate decision, however, propelled prices sharply higher. Hawkish Fed comments Friday strengthened the U.S. dollar and moved prices off their highs. Silver and platinum prices outperformed gold prices, moving in line with base metal prices. Platinum prices soared 24% higher.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Dec 15

18 December, 2023 | Jeff Klearman

Gold prices performed similarly to oil prices, falling early in the week and then recouping all and more of those losses the remainder. Future Fed policy doubts, in front of Wednesday’s FOMC announcement, pushed gold prices markedly lower Tuesday after a somewhat lackluster CPI release. Wednesday’s dovish comments accompanying an as-expected FOMC rate decision, however, propelled prices sharply higher. Hawkish Fed comments Friday strengthened the U.S. dollar and moved prices off their highs. Silver and platinum prices outperformed gold prices, moving in line with base metal prices. Platinum prices soared 24% higher.

Oil prices moved lower last week, affected by both demand and supply concerns. Prices continued to react negatively to last week's OPEC+ announcement calling for increased but voluntary production cutbacks and to increased global demand concerns. Wednesday’s EIA release showing a much larger-than-expected build in gasoline stocks particularly unsettled markets, pushing WTI crude oil prices over 4% lower. Friday’s stronger-than-expected jobs report and Saudi Arabia’s and Russia’s entreaty to other OPEC+ members to reduce production lifted prices about 3% higher, moving prices off of Thursday’s lows. Natural gas prices fell 8%, reacting to warm-weather forecasts, increased production and high inventory levels.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Dec 08

11 December, 2023 | Jeff Klearman

Oil prices moved lower last week, affected by both demand and supply concerns. Prices continued to react negatively to last week's OPEC+ announcement calling for increased but voluntary production cutbacks and to increased global demand concerns. Wednesday’s EIA release showing a much larger-than-expected build in gasoline stocks particularly unsettled markets, pushing WTI crude oil prices over 4% lower. Friday’s stronger-than-expected jobs report and Saudi Arabia’s and Russia’s entreaty to other OPEC+ members to reduce production lifted prices about 3% higher, moving prices off of Thursday’s lows. Natural gas prices fell 8%, reacting to warm-weather forecasts, increased production and high inventory levels.

Spot gold prices continued to rise last week, benefiting from increased expectations of a “sooner-than-expected” Fed pivot, falling longer-term Treasury rates and a slightly weaker U.S. dollar. Interestingly, Thursday’s PCE Price Index release, showing lower-than-expected inflation, resulted in a stronger U.S. dollar and lower gold prices, seemingly reflecting market uncertainty regarding future Fed monetary policy. Friday’s comments by Fed Chair Jerome Powell, however, all but admitting its reluctance to raise rates further, pushed gold prices sharply higher. Silver and platinum prices also rose last week, with silver prices outperforming and platinum prices underperforming gold prices.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Dec 01

04 December, 2023 | Jeff Klearman

Spot gold prices continued to rise last week, benefiting from increased expectations of a “sooner-than-expected” Fed pivot, falling longer-term Treasury rates and a slightly weaker U.S. dollar. Interestingly, Thursday’s PCE Price Index release, showing lower-than-expected inflation, resulted in a stronger U.S. dollar and lower gold prices, seemingly reflecting market uncertainty regarding future Fed monetary policy. Friday’s comments by Fed Chair Jerome Powell, however, all but admitting its reluctance to raise rates further, pushed gold prices sharply higher. Silver and platinum prices also rose last week, with silver prices outperforming and platinum prices underperforming gold prices.

Oil prices ended slightly lower on the week, belying volatility due to OPEC+ supply concerns. Prices rose north of 2% Monday, climbing on OPEC+ comments that they were considering additional cutbacks. Prices then moved sharply lower Wednesday and Friday following a postponement of the scheduled November 26 OPEC+ meeting (due to internal cutback/production disagreements) and a larger-than-expected build in U.S. inventories.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Nov 24

27 November, 2023 | Jeff Klearman

Oil prices ended slightly lower on the week, belying volatility due to OPEC+ supply concerns. Prices rose north of 2% Monday, climbing on OPEC+ comments that they were considering additional cutbacks. Prices then moved sharply lower Wednesday and Friday following a postponement of the scheduled November 26 OPEC+ meeting (due to internal cutback/production disagreements) and a larger-than-expected build in U.S. inventories.

Spot gold prices rose last week, benefiting from a combination of cooling inflation and weaker-than-expected economic data. Tuesday’s better-than-expected CPI release pushed 10-year Treasury rates almost 20bps lower and significantly weakened the U.S. dollar, driving gold prices higher. Declining PPI and retail sales numbers (MoM) combined with larger-than-expected initial jobless claims, added to expectations of a Fed pivot sooner than previously expected, adding to upward price momentum. Silver, platinum and palladium prices also rose last week, outperforming gold prices.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Nov 17

20 November, 2023 | Jeff Klearman

Spot gold prices rose last week, benefiting from a combination of cooling inflation and weaker-than-expected economic data. Tuesday’s better-than-expected CPI release pushed 10-year Treasury rates almost 20bps lower and significantly weakened the U.S. dollar, driving gold prices higher. Declining PPI and retail sales numbers (MoM) combined with larger-than-expected initial jobless claims, added to expectations of a Fed pivot sooner than previously expected, adding to upward price momentum. Silver, platinum and palladium prices also rose last week, outperforming gold prices.

Oil prices moved lower again last week struggling against a background of continued weak Chinese and European economic data. Hawkish comments from Fed Chairman Powell as well as from ECB and BoE officials also worked to pressure prices by dimming demand expectations. Prices also suffered from a much larger-than-expected U.S. inventory build (according to the API) and from EIA forecasts of weaker demand and growing supply next year. Natural gas prices moved sharply lower (down 14%), reeling from increased production, November warm-weather forecasts and weak LNG exports.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Nov 10

13 November, 2023 | Jeff Klearman

Oil prices moved lower again last week struggling against a background of continued weak Chinese and European economic data. Hawkish comments from Fed Chairman Powell as well as from ECB and BoE officials also worked to pressure prices by dimming demand expectations. Prices also suffered from a much larger-than-expected U.S. inventory build (according to the API) and from EIA forecasts of weaker demand and growing supply next year. Natural gas prices moved sharply lower (down 14%), reeling from increased production, November warm-weather forecasts and weak LNG exports.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Nov 3

06 November, 2023 | Jeff Klearman

Spot gold prices moved higher again last week primarily on haven-based buying. Prices fell through Tuesday with lessened Mid-East concerns but then moved higher the remainder of the week as though concerns increased, especially on Friday. Silver prices ended the week about 1% lower while platinum prices moved higher by about 1%.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Oct 27

30 October, 2023 | Jeff Klearman

Spot gold prices moved higher again last week primarily on haven-based buying. Prices fell through Tuesday with lessened Mid-East concerns but then moved higher the remainder of the week as though concerns increased, especially on Friday. Silver prices ended the week about 1% lower while platinum prices moved higher by about 1%.

Oil prices moved higher last week supported by escalation fears of the Israel-Hamas war and robust Chinese and U.S. economic data. Prices also benefited from a much larger-than-expected drawdown in U.S. inventories. Fed Chair Powell’s comments Thursday, stating current monetary policy is not overly restrictive, and the easing of U.S. sanction on Venezuela may have worked to cap gains. Natural gas prices dropped 8%, falling on strong production numbers.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Oct 20

23 October, 2023 | Jeff Klearman

Oil prices moved higher last week supported by escalation fears of the Israel-Hamas war and robust Chinese and U.S. economic data. Prices also benefited from a much larger-than-expected drawdown in U.S. inventories. Fed Chair Powell’s comments Thursday, stating current monetary policy is not overly restrictive, and the easing of U.S. sanction on Venezuela may have worked to cap gains. Natural gas prices dropped 8%, falling on strong production numbers.

Oil prices rose last week, driven by growing contagion concerns of the Israel-Hamas war. Prices rose almost 4% Monday but then drifted lower as initial concerns receded and on Thursday’s EIA report showing a much larger-than-expected build in inventories. Friday saw prices sharply rise following reports of Israel commencing its ground offensive in Gaza. Natural gas prices fell slightly on no real news.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Oct 13

16 October, 2023 | Jeff Klearman

Oil prices rose last week, driven by growing contagion concerns of the Israel-Hamas war. Prices rose almost 4% Monday but then drifted lower as initial concerns receded and on Thursday’s EIA report showing a much larger-than-expected build in inventories. Friday saw prices sharply rise following reports of Israel commencing its ground offensive in Gaza. Natural gas prices fell slightly on no real news.

Oil and derivate product prices moved sharply lower last week. Prices dropped 6% Wednesday primarily due to a much larger-than-expected build in gasoline inventories and a markedly reduced “gasoline supplied” number. Wednesday’s weakness was compounded by Russia’s termination of its oil products ban, announced Friday but expected by the market Thursday. Friday’s stronger-than-expected payroll report left prices slightly higher with the market unsure if the report portends stronger or weaker demand. Natural gas prices surged last week, rising on much lower-than-expected inventory levels and cool weather forecasted for later this month.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Oct 6

09 October, 2023 | Jeff Klearman

Oil and derivate product prices moved sharply lower last week. Prices dropped 6% Wednesday primarily due to a much larger-than-expected build in gasoline inventories and a markedly reduced “gasoline supplied” number. Wednesday’s weakness was compounded by Russia’s termination of its oil products ban, announced Friday but expected by the market Thursday. Friday’s stronger-than-expected payroll report left prices slightly higher with the market unsure if the report portends stronger or weaker demand. Natural gas prices surged last week, rising on much lower-than-expected inventory levels and cool weather forecasted for later this month.

WTI crude oil prices ended the week higher but significantly off intraweek highs. Prices moved higher through Wednesday, propelled by Russia’s oil product export ban and a surprise larger-than-expected drop in U.S. oil inventories. Economic growth concerns enveloped the oil markets Thursday and Friday with “higher-rates-for-longer” expectations and worries about a weak Chinese economy pushing prices lower.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Sep 29

02 October, 2023 | Jeff Klearman

WTI crude oil prices ended the week higher but significantly off intraweek highs. Prices moved higher through Wednesday, propelled by Russia’s oil product export ban and a surprise larger-than-expected drop in U.S. oil inventories. Economic growth concerns enveloped the oil markets Thursday and Friday with “higher-rates-for-longer” expectations and worries about a weak Chinese economy pushing prices lower.

WTI crude oil prices were unchanged last week moving off intraweek highs set Tuesday following Wednesday’s FOMC announcement. Supply concerns, stemming mainly from OPEC+ production/export cutbacks, were increased after a larger-than-expected fall in U.S. oil inventories, Russia’s implementation of high export duties on oil products and a decline in shale oil production. Demand concerns, however, seemed to dominate the week spearheaded by hawkish messages from the Fed, BoE and ECB and exacerbated by high oil prices themselves increasing expectations of global recession. Brent crude oil prices finished the week 2% lower.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Sep 22

25 September, 2023 | Jeff Klearman

WTI crude oil prices were unchanged last week moving off intraweek highs set Tuesday following Wednesday’s FOMC announcement. Supply concerns, stemming mainly from OPEC+ production/export cutbacks, were increased after a larger-than-expected fall in U.S. oil inventories, Russia’s implementation of high export duties on oil products and a decline in shale oil production. Demand concerns, however, seemed to dominate the week spearheaded by hawkish messages from the Fed, BoE and ECB and exacerbated by high oil prices themselves increasing expectations of global recession. Brent crude oil prices finished the week 2% lower.

Oil moved higher again last week, driven by both supply and demand factors. Tuesday the EIA forecasted oil demand growth into next year would outpace oil production increases, with a significant decline in inventories through year-end. The IEA on Wednesday, however, reduced its demand growth projections for the Q4 by 600,000 bpd though added OPEC+ production cutbacks would result in a supply deficit. This combined with a surprise increase in U.S. inventories resulted in the only down-day for oil, with prices declining a meager 1/3 percent. Positive economic data out of China, including growing bank loans, no deflation and better-than-expected retail sales and industrial production, added to demand expectations, providing another impetus for higher prices.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Sep 15

18 September, 2023 | Jeff Klearman

Oil moved higher again last week, driven by both supply and demand factors. Tuesday the EIA forecasted oil demand growth into next year would outpace oil production increases, with a significant decline in inventories through year-end. The IEA on Wednesday, however, reduced its demand growth projections for the Q4 by 600,000 bpd though added OPEC+ production cutbacks would result in a supply deficit. This combined with a surprise increase in U.S. inventories resulted in the only down-day for oil, with prices declining a meager 1/3 percent. Positive economic data out of China, including growing bank loans, no deflation and better-than-expected retail sales and industrial production, added to demand expectations, providing another impetus for higher prices.

Oil prices continued their move higher, powered by supply concerns and strong U.S. economic data. Saudi Arabia’s and Russia’s extension of voluntary production cutbacks through the end of the year and sharp, larger-than-expected drawdowns in U.S. inventories significantly contributed to last week’s price rise. Strong U.S. economic data (i.e, lower-than-expected jobless claims and stronger-than-expected ISM Services Index) increased demand expectations, moving prices higher as well. Weak euro zone and Chinese economic data and a strengthening U.S. dollar worked to cap gains.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Sep 8

11 September, 2023 | Jeff Klearman

Oil prices continued their move higher, powered by supply concerns and strong U.S. economic data. Saudi Arabia’s and Russia’s extension of voluntary production cutbacks through the end of the year and sharp, larger-than-expected drawdowns in U.S. inventories significantly contributed to last week’s price rise. Strong U.S. economic data (i.e, lower-than-expected jobless claims and stronger-than-expected ISM Services Index) increased demand expectations, moving prices higher as well. Weak euro zone and Chinese economic data and a strengthening U.S. dollar worked to cap gains.

Oil prices moved higher every single day last week. Gulf coast production concerns precipitated by Hurricane Idalia supplied early-week impetus for higher prices followed by growing hopes of a more restrained Fed after weaker-than-expected JOLTS, consumer confidence and GDP reports. Expectations of continued OPEC+ production/export cutbacks through October and a larger-than-expected decline in U.S. inventories also helped move prices higher the remainder of the week. Oil prices ended the week up between 6% and 7% while gasoline prices lost about 1% and heating oil prices declined close to 4%. Heating oil prices fell on continued inventory increases.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Sep 1

05 September, 2023 | Jeff Klearman

Oil prices moved higher every single day last week. Gulf coast production concerns precipitated by Hurricane Idalia supplied early-week impetus for higher prices followed by growing hopes of a more restrained Fed after weaker-than-expected JOLTS, consumer confidence and GDP reports. Expectations of continued OPEC+ production/export cutbacks through October and a larger-than-expected decline in U.S. inventories also helped move prices higher the remainder of the week. Oil prices ended the week up between 6% and 7% while gasoline prices lost about 1% and heating oil prices declined close to 4%. Heating oil prices fell on continued inventory increases.

Spot gold prices rose last week (up almost 1.5%), rising in front of Fed Chair Powell’s Friday Jackson Hole speech with investors seemingly expecting more accommodating Fed monetary policy going forward. Gold prices rose every day but Friday last week, moving almost 1% higher Wednesday following a much weaker-than-expected PMI Composite Index. Thursday’s sharp drop in durable goods orders also supported gold prices offsetting lower-than-expected initial jobless claims. Powell’s speech Friday seemed to align with market expectations with Powell reiterating the need to remain vigilant but to act carefully going forward

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Aug 25

28 August, 2023 | Jeff Klearman

Spot gold prices rose last week (up almost 1.5%), rising in front of Fed Chair Powell’s Friday Jackson Hole speech with investors seemingly expecting more accommodating Fed monetary policy going forward. Gold prices rose every day but Friday last week, moving almost 1% higher Wednesday following a much weaker-than-expected PMI Composite Index. Thursday’s sharp drop in durable goods orders also supported gold prices offsetting lower-than-expected initial jobless claims. Powell’s speech Friday seemed to align with market expectations with Powell reiterating the need to remain vigilant but to act carefully going forward

Oil prices finished the week lower, breaking a streak of weekly increases. Prices moved lower the first half of the week, falling on weak Chinese economic data and concomitant demand concerns. The BoC’s move to support China’s flailing property market as well as a drawdown in China crude oil inventories pushed prices higher Thursday while a drop in oil and gas rigs for the 6th consecutive week (as reported by the Baker-Hughes Rig Count Report) bolstered prices Friday. Falling gasoline stocks, indicating strong gasoline demand, also supported prices.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Aug 18

21 August, 2023 | Jeff Klearman

Oil prices finished the week lower, breaking a streak of weekly increases. Prices moved lower the first half of the week, falling on weak Chinese economic data and concomitant demand concerns. The BoC’s move to support China’s flailing property market as well as a drawdown in China crude oil inventories pushed prices higher Thursday while a drop in oil and gas rigs for the 6th consecutive week (as reported by the Baker-Hughes Rig Count Report) bolstered prices Friday. Falling gasoline stocks, indicating strong gasoline demand, also supported prices.

Another up-and-down week for oil prices with prices continuing to move higher, though only slightly. Flip-flopping demand expectations were the primary impetus for the vacillations with concerns of continued high rates dimming economic growth competing against projections (by the EIA) of strong U.S. GDP growth and forecasts of record oil demand (by the IEA). Weak Chinese economic data (plunging new bank loans and weak trade data) also increased demand concerns. While oil prices rose less than ½ percent last week, gasoline prices rose about 4% and natural gas prices gained 9%

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Aug 11

14 August, 2023 | Jeff Klearman

Another up-and-down week for oil prices with prices continuing to move higher, though only slightly. Flip-flopping demand expectations were the primary impetus for the vacillations with concerns of continued high rates dimming economic growth competing against projections (by the EIA) of strong U.S. GDP growth and forecasts of record oil demand (by the IEA). Weak Chinese economic data (plunging new bank loans and weak trade data) also increased demand concerns. While oil prices rose less than ½ percent last week, gasoline prices rose about 4% and natural gas prices gained 9%

Spot gold prices moved lower last week (down 1%), reacting primarily to higher Treasury rates and a stronger U.S. dollar. While Fitch Ratings’ U.S. credit downgrade initially moved prices higher, the Treasury’s much larger-than-expected funding needs (as well as the downgrade itself) pushed Treasury yields markedly higher over Wednesday and Thursday, dampening demand for gold. Friday’s mixed jobs report, showing a smaller-than-expected increase in payrolls, ameliorated higher-rate concerns, moving rate and the U.S. dollar and, consequently, helping gold prices move higher. Platinum prices moved with gold prices while silver prices underperformed, falling 3%.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Aug 4

07 August, 2023 | Jeff Klearman

Spot gold prices moved lower last week (down 1%), reacting primarily to higher Treasury rates and a stronger U.S. dollar. While Fitch Ratings’ U.S. credit downgrade initially moved prices higher, the Treasury’s much larger-than-expected funding needs (as well as the downgrade itself) pushed Treasury yields markedly higher over Wednesday and Thursday, dampening demand for gold. Friday’s mixed jobs report, showing a smaller-than-expected increase in payrolls, ameliorated higher-rate concerns, moving rate and the U.S. dollar and, consequently, helping gold prices move higher. Platinum prices moved with gold prices while silver prices underperformed, falling 3%.

A volatile week for gold prices with spot prices moving higher 0.6% through Wednesday, falling 1.4% Thursday and then gaining ¾ percent Friday to end the week almost unchanged. Increased hopes and expectations of a less aggressive Fed going forward before and following Wednesday’s FOMC decision were the primary impetus for the increase in gold prices through Wednesday. Smaller-than-expected initial jobless claims and greater-than-expected GDP growth renewed concerns of additional rate hikes (or rates remaining higher for longer), driving gold prices sharply lower. Those losses were partially recouped Friday after better-than-expected inflation data (i.e., PCE Price Index and ECI releases). Silver and platinum prices underperformed gold prices, falling 1% and 2%, respectively.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jul 28

31 July, 2023 | Jeff Klearman

A volatile week for gold prices with spot prices moving higher 0.6% through Wednesday, falling 1.4% Thursday and then gaining ¾ percent Friday to end the week almost unchanged. Increased hopes and expectations of a less aggressive Fed going forward before and following Wednesday’s FOMC decision were the primary impetus for the increase in gold prices through Wednesday. Smaller-than-expected initial jobless claims and greater-than-expected GDP growth renewed concerns of additional rate hikes (or rates remaining higher for longer), driving gold prices sharply lower. Those losses were partially recouped Friday after better-than-expected inflation data (i.e., PCE Price Index and ECI releases). Silver and platinum prices underperformed gold prices, falling 1% and 2%, respectively.

Grain prices moved higher last week predominantly due to Russia’s withdrawal from the Black Sea export agreement. Prices, especially Chicago wheat prices, closed the week off their Thursday’s highs, affected by favorable longer-term weather forecasts and increased estimates of Brazil second corn and U.S. spring wheat harvests. Wheat and corn prices also moved higher on Russia’s pronouncement freighters entering the Black Sea would be considered hostile and subject to attack.

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jul 21

24 July, 2023 | Jeff Klearman

Grain prices moved higher last week predominantly due to Russia’s withdrawal from the Black Sea export agreement. Prices, especially Chicago wheat prices, closed the week off their Thursday’s highs, affected by favorable longer-term weather forecasts and increased estimates of Brazil second corn and U.S. spring wheat harvests. Wheat and corn prices also moved higher on Russia’s pronouncement freighters entering the Black Sea would be considered hostile and subject to attack.

Spot gold prices also moved higher on the week, benefiting from the same factors as the U.S. stock market and oil prices. Better-than-expected CPI (headline and core) and PPI releases and increased expectations of a Fed pivot sooner than later, markedly depreciated the U.S. dollar, pushing gold prices higher throughout the week. Gold prices slightly retreated Friday on a marginally stronger U.S. dollar

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jul 14

17 July, 2023 | Jeff Klearman

Spot gold prices also moved higher on the week, benefiting from the same factors as the U.S. stock market and oil prices. Better-than-expected CPI (headline and core) and PPI releases and increased expectations of a Fed pivot sooner than later, markedly depreciated the U.S. dollar, pushing gold prices higher throughout the week. Gold prices slightly retreated Friday on a marginally stronger U.S. dollar

Spot gold prices ended the week slightly higher thanks to Friday’s mixed jobs report. Down ½ percent through Thursday on hawkish FOMC minutes (released Wednesday) and a stronger-than-expected ISM Services release Thursday, gold prices rose ¾ percent Friday following a jobs report headlining a weaker-than-expected increase in payrolls. A weaker U.S. dollar (down over ¾ percent Friday) also supported prices. Silver and platinum prices moved higher as well, outperforming gold prices over the week.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jul 7

10 July, 2023 | Jeff Klearman

Spot gold prices ended the week slightly higher thanks to Friday’s mixed jobs report. Down ½ percent through Thursday on hawkish FOMC minutes (released Wednesday) and a stronger-than-expected ISM Services release Thursday, gold prices rose ¾ percent Friday following a jobs report headlining a weaker-than-expected increase in payrolls. A weaker U.S. dollar (down over ¾ percent Friday) also supported prices. Silver and platinum prices moved higher as well, outperforming gold prices over the week.

Oil prices moved higher last week propelled by sharply falling inventory levels and stronger-than-expected U.S. economic data. The increase came even as the Fed, ECB and BoE reiterated the need for higher rates for longer. Demand expectations rose, however, occurring as U.S. inflation fell more than expected (the PCE Price Index release Friday was lower-than-expected) with economic data indicating both a strong job and housing market and robust consumer confidence. Natural gas prices end the week about 2% lower but well off intraweek lows.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 30

03 July, 2023 | Jeff Klearman

Oil prices moved higher last week propelled by sharply falling inventory levels and stronger-than-expected U.S. economic data. The increase came even as the Fed, ECB and BoE reiterated the need for higher rates for longer. Demand expectations rose, however, occurring as U.S. inflation fell more than expected (the PCE Price Index release Friday was lower-than-expected) with economic data indicating both a strong job and housing market and robust consumer confidence. Natural gas prices end the week about 2% lower but well off intraweek lows.

Spot gold prices moved about 2% lower last week reacting to a strong housing starts number and Fed Chair Powell’s hawkish testimony before congress Wednesday and Thursday. The BoE’s surprise 50bp rate hike added to concerns of higher rates and failed to weaken the U.S. dollar, also pressuring gold prices lower. Silver and platinum prices were sharply lower, falling 7% and 6%, respectively, on the week, moving lower with gold and base metal prices.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 23

26 June, 2023 | Jeff Klearman

Spot gold prices moved about 2% lower last week reacting to a strong housing starts number and Fed Chair Powell’s hawkish testimony before congress Wednesday and Thursday. The BoE’s surprise 50bp rate hike added to concerns of higher rates and failed to weaken the U.S. dollar, also pressuring gold prices lower. Silver and platinum prices were sharply lower, falling 7% and 6%, respectively, on the week, moving lower with gold and base metal prices.

Base metal prices moved higher last week primarily due to Chinese rate cuts and additional fiscal stimulus. Lower Monday on Fed rate-hike and Chinese demand concerns, copper prices moved higher the remainder of the week, primarily supported by BoC borrowing rate cuts and Chinese government fiscal stimulus. Relatively strong U.S. economic data combined with a markedly weaker U.S. dollar also supported base metal prices.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 16

20 June, 2023 | Jeff Klearman

Base metal prices moved higher last week primarily due to Chinese rate cuts and additional fiscal stimulus. Lower Monday on Fed rate-hike and Chinese demand concerns, copper prices moved higher the remainder of the week, primarily supported by BoC borrowing rate cuts and Chinese government fiscal stimulus. Relatively strong U.S. economic data combined with a markedly weaker U.S. dollar also supported base metal prices.

Through mid-week, oil prices moved higher, supported primarily by Saudi Arabia’s plans to reduce output another 1 million bpd beginning in July. Much greater-than-expected builds in U.S. gasoline and diesel/heating oil inventories combined with weaker-than-expected Chinese economic data helped pull prices lower the remainder of the week with WTI crude oil prices finishing the week down over 2%. Reports Thursday of a U.S.-Iran nuclear agreement also pressured prices lower.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 9

12 June, 2023 | Jeff Klearman

Through mid-week, oil prices moved higher, supported primarily by Saudi Arabia’s plans to reduce output another 1 million bpd beginning in July. Much greater-than-expected builds in U.S. gasoline and diesel/heating oil inventories combined with weaker-than-expected Chinese economic data helped pull prices lower the remainder of the week with WTI crude oil prices finishing the week down over 2%. Reports Thursday of a U.S.-Iran nuclear agreement also pressured prices lower.

Oil prices ended the week slightly over 1% lower but rebounded sharply Thursday and Friday from steep declines registered Tuesday and Wednesday. Weaker-than-expected Chinese manufacturing activity and debt ceiling resolution concerns drove WTI crude oil prices over 6% lower through Wednesday. Those losses, however, were mostly reversed Thursday and Friday following passage by the House and Senate of the debt ceiling bill, a stronger-than-expected Caixin/S&P Global PMI release and growing expectations of a pause in Fed rate hikes.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 2

05 June, 2023 | Jeff Klearman

Oil prices ended the week slightly over 1% lower but rebounded sharply Thursday and Friday from steep declines registered Tuesday and Wednesday. Weaker-than-expected Chinese manufacturing activity and debt ceiling resolution concerns drove WTI crude oil prices over 6% lower through Wednesday. Those losses, however, were mostly reversed Thursday and Friday following passage by the House and Senate of the debt ceiling bill, a stronger-than-expected Caixin/S&P Global PMI release and growing expectations of a pause in Fed rate hikes.

Oil prices ended the week higher, rising every day but one during the week. Rising gasoline prices (in front of Memorial Day Weekend) and falling oil, gasoline and distillate inventories helped move prices higher throughout the week. Comments from Saudi Arabia’s energy minister warning short sellers of potential “pain” and Friday’s report of progress in debt ceiling talks also contributed to gains. Prices fell Thursday (the only down day) following comments from Russian officials expressing doubts regarding additional production cutbacks (seemingly contradicting comments from Saudi’s energy minister). Natural gas prices reversed the previous week’s sharp gains, falling almost 11% amidst strong production combined with weak weather-related demand.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: May 26

30 May, 2023 | Jeff Klearman

Oil prices ended the week higher, rising every day but one during the week. Rising gasoline prices (in front of Memorial Day Weekend) and falling oil, gasoline and distillate inventories helped move prices higher throughout the week. Comments from Saudi Arabia’s energy minister warning short sellers of potential “pain” and Friday’s report of progress in debt ceiling talks also contributed to gains. Prices fell Thursday (the only down day) following comments from Russian officials expressing doubts regarding additional production cutbacks (seemingly contradicting comments from Saudi’s energy minister). Natural gas prices reversed the previous week’s sharp gains, falling almost 11% amidst strong production combined with weak weather-related demand.

Gold prices, too, mainly moved with debt ceiling resolution expectations. Higher Monday on debt ceiling concerns and a weaker U.S. dollar, gold prices fell Tuesday through Thursday on news of progress in debt ceiling talks but also on hawkish Fed comments and decent economic news. Gold prices shot higher Friday (up 1%) following news the debt ceiling talks had been paused. Gold and silver prices ended lower on the week while spot platinum prices closed the week about 1% higher.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: May 19

22 May, 2023 | Jeff Klearman

Gold prices, too, mainly moved with debt ceiling resolution expectations. Higher Monday on debt ceiling concerns and a weaker U.S. dollar, gold prices fell Tuesday through Thursday on news of progress in debt ceiling talks but also on hawkish Fed comments and decent economic news. Gold prices shot higher Friday (up 1%) following news the debt ceiling talks had been paused. Gold and silver prices ended lower on the week while spot platinum prices closed the week about 1% higher.

Spot gold prices also moved higher early in the week, climbing just under 1% through Tuesday on U.S. banking and recession concerns. Tighter credit conditions, as reported by the Fed, increased expectations the Fed would be more likely to ease this year also supported prices. Despite Wednesday’s slightly better-than-expected CPI release, expectations of the Fed easing later this year fell with sentiment influenced by the stubbornly high level of inflation. Friday’s University of Michigan Consumer Sentiment Report showing rising inflation expectations added to this sentiment, driving Treasury rates and the dollar higher while pushing gold prices lower.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: May 12

15 May, 2023 | Jeff Klearman

Spot gold prices also moved higher early in the week, climbing just under 1% through Tuesday on U.S. banking and recession concerns. Tighter credit conditions, as reported by the Fed, increased expectations the Fed would be more likely to ease this year also supported prices. Despite Wednesday’s slightly better-than-expected CPI release, expectations of the Fed easing later this year fell with sentiment influenced by the stubbornly high level of inflation. Friday’s University of Michigan Consumer Sentiment Report showing rising inflation expectations added to this sentiment, driving Treasury rates and the dollar higher while pushing gold prices lower.

Spot gold prices moved oppositely to stock prices last week. Rallying on banking system, U.S. default and recession concerns, gold prices rose over 3% through Thursday. About half those gains were removed Friday following a stronger-than-expected U.S. jobs report and sharply lessened banking system concerns. For the week, spot gold prices rose just under 1.5% while spot silver prices gained about 2.5%. Platinum and palladium prices fell about 1%,

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: May 5

08 May, 2023 | Jeff Klearman

Spot gold prices moved oppositely to stock prices last week. Rallying on banking system, U.S. default and recession concerns, gold prices rose over 3% through Thursday. About half those gains were removed Friday following a stronger-than-expected U.S. jobs report and sharply lessened banking system concerns. For the week, spot gold prices rose just under 1.5% while spot silver prices gained about 2.5%. Platinum and palladium prices fell about 1%,

Copper prices end the week lower, falling through Tuesday on weak Chinese demand, increased supplies and a stronger U.S. dollar. Prices then partially rebounded the remainder of the weak supported by a weaker U.S. dollar, Chinese stimulus plans and, for the most part, an as-expected PCE Price Index release. Other base metal prices followed copper prices lower.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Apr 28

28 April, 2023 | Jeff Klearman

Copper prices end the week lower, falling through Tuesday on weak Chinese demand, increased supplies and a stronger U.S. dollar. Prices then partially rebounded the remainder of the weak supported by a weaker U.S. dollar, Chinese stimulus plans and, for the most part, an as-expected PCE Price Index release. Other base metal prices followed copper prices lower.

A volatile week for gold prices with spot gold prices alternatively falling and rising at least ½ percent each day. Fluctuating expectations of future Fed action and the possible concomitant results on the U.S. economy see-sawed both Treasury rates and the level of the U.S. dollar throughout the week and, as a result, affected gold prices likewise. Spot gold prices, unchanged through Thursday, fell 1% Friday following a much stronger-than-expected S&P Global Composite PMI release. Silver prices fared the same as gold prices. Platinum prices finished the week 8% higher, affected by South African production disruptions due to power outages.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Apr 21

24 April, 2023 | Jeff Klearman

A volatile week for gold prices with spot gold prices alternatively falling and rising at least ½ percent each day. Fluctuating expectations of future Fed action and the possible concomitant results on the U.S. economy see-sawed both Treasury rates and the level of the U.S. dollar throughout the week and, as a result, affected gold prices likewise. Spot gold prices, unchanged through Thursday, fell 1% Friday following a much stronger-than-expected S&P Global Composite PMI release. Silver prices fared the same as gold prices. Platinum prices finished the week 8% higher, affected by South African production disruptions due to power outages.

Spot gold prices ended the week lower but only after moving sharply lower Friday. Prices started the week lower, pressured by the previous Friday’s resilient job report adding to expectations the Fed would continue to tighten and raise rates 25bps in May. Those expectations lessened through Thursday as lower-than-expected CPI and PPI releases provided reason for increased expectations of a Fed pivot. Gold prices (up 1.5% through Thursday), however, fell sharply Friday following hawkish Fed officials’ comments.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Apr 14

17 April, 2023 | Jeff Klearman

Spot gold prices ended the week lower but only after moving sharply lower Friday. Prices started the week lower, pressured by the previous Friday’s resilient job report adding to expectations the Fed would continue to tighten and raise rates 25bps in May. Those expectations lessened through Thursday as lower-than-expected CPI and PPI releases provided reason for increased expectations of a Fed pivot. Gold prices (up 1.5% through Thursday), however, fell sharply Friday following hawkish Fed officials’ comments.

Powered by weaker-than-expected economic data, spot gold prices moved 2% higher last week, closing above $2000/Ounce Tuesday, Wednesday and Thursday. A 2-year low in job openings, sharply declining factory activity and larger-than-expected initial jobless claims increased expectations of less aggressive Fed monetary policy, strongly supporting gold prices.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Apr 7

10 April, 2023 | Jeff Klearman

Powered by weaker-than-expected economic data, spot gold prices moved 2% higher last week, closing above $2000/Ounce Tuesday, Wednesday and Thursday. A 2-year low in job openings, sharply declining factory activity and larger-than-expected initial jobless claims increased expectations of less aggressive Fed monetary policy, strongly supporting gold prices.

Gold prices moved slightly lower again last week, pressured by diminished banking-sector concerns and a mixed PCE Price Index release Friday. See-sawing throughout the week, gold prices through Thursday were up less than ¼ percent. Friday’s PCE Price Index release, coming in below expectations, initially moved gold prices higher but emerging concerns surrounding core and services prices (remaining on the higher side) pushed spot prices about ½ percent lower on the day and, as a result, for the week as well. Silver prices moved noticeably higher, gaining 4% and platinum prices rose 2%, both following base metal prices higher.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Mar 31

03 April, 2023 | Jeff Klearman

Gold prices moved slightly lower again last week, pressured by diminished banking-sector concerns and a mixed PCE Price Index release Friday. See-sawing throughout the week, gold prices through Thursday were up less than ¼ percent. Friday’s PCE Price Index release, coming in below expectations, initially moved gold prices higher but emerging concerns surrounding core and services prices (remaining on the higher side) pushed spot prices about ½ percent lower on the day and, as a result, for the week as well. Silver prices moved noticeably higher, gaining 4% and platinum prices rose 2%, both following base metal prices higher.

Gold prices ended lower for the week (about ½ percent lower) but significantly off lows sent Tuesday. Down almost 2.5% on diminished banking concerns Tuesday, gold prices rallied following an as-an expected FOMC rate hike and despite hawkish Fed Chair Powell comments. Powell, following the announcement in his press conference, stated he did not expect the Fed to ease this year. Markets, however, thought otherwise, pricing in at least 1 rate decrease in 2023, moving gold prices markedly higher Wednesday and Thursday. Prices fell Friday perhaps on increased risk-on sentiment and on a stronger U.S. dollar.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Mar 24

27 March, 2023 | Jeff Klearman

Gold prices ended lower for the week (about ½ percent lower) but significantly off lows sent Tuesday. Down almost 2.5% on diminished banking concerns Tuesday, gold prices rallied following an as-an expected FOMC rate hike and despite hawkish Fed Chair Powell comments. Powell, following the announcement in his press conference, stated he did not expect the Fed to ease this year. Markets, however, thought otherwise, pricing in at least 1 rate decrease in 2023, moving gold prices markedly higher Wednesday and Thursday. Prices fell Friday perhaps on increased risk-on sentiment and on a stronger U.S. dollar.

Gold and silver prices moved sharply higher last week powered by greatly increased banking-system concerns (safe-haven demand) and growing expectations the Fed would refrain from raising rates at this week’s FOMC meeting. Spot gold prices rose nearly 6% last week. Spot silver prices moved more markedly, rising almost 11% on the week.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Mar 17

20 March, 2023 | Jeff Klearman

Gold and silver prices moved sharply higher last week powered by greatly increased banking-system concerns (safe-haven demand) and growing expectations the Fed would refrain from raising rates at this week’s FOMC meeting. Spot gold prices rose nearly 6% last week. Spot silver prices moved more markedly, rising almost 11% on the week.

Gold prices moved higher last week, overcoming an early week drop, in the face of changing Fed policy expectations. Down over 2% through Tuesday, predominantly due to hawkish testimony by Fed Chair Powell, gold prices rose sharply Thursday and Friday following news of Silicon Valley Bank’s distress (Thursday) and then failure on Friday. Growing expectations the Fed would need to dial back its tightening plans in the face of uncertainty surrounding the banking industry as well as on a dovish jobs report Friday, pushed 10-year Treasury rates markedly lower and weakened the U.S. dollar, both supportive of gold prices.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Mar 10

13 March, 2023 | Jeff Klearman

Gold prices moved higher last week, overcoming an early week drop, in the face of changing Fed policy expectations. Down over 2% through Tuesday, predominantly due to hawkish testimony by Fed Chair Powell, gold prices rose sharply Thursday and Friday following news of Silicon Valley Bank’s distress (Thursday) and then failure on Friday. Growing expectations the Fed would need to dial back its tightening plans in the face of uncertainty surrounding the banking industry as well as on a dovish jobs report Friday, pushed 10-year Treasury rates markedly lower and weakened the U.S. dollar, both supportive of gold prices.

Base metal prices moved higher last week supported by expectations of increasing Chinese demand, a weaker U.S. dollar and hopes of a more restrained Fed. Chinese economic data showing much stronger-than-expected economic activity added to expectations of growing demand from China as did stimulus expectations surrounding the weekend’s “2-session meetings”.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Mar 3

06 March, 2023 | Jeff Klearman

Base metal prices moved higher last week supported by expectations of increasing Chinese demand, a weaker U.S. dollar and hopes of a more restrained Fed. Chinese economic data showing much stronger-than-expected economic activity added to expectations of growing demand from China as did stimulus expectations surrounding the weekend’s “2-session meetings”.

WTI Crude oil prices ended the week slightly lower, belying intraweek volatility fostered by competing demand and supply concerns. Sharply lower Tuesday, prices reacted to growing concerns of Fed-induced demand destruction in the face of a seemingly resilient job market and economy. FOMC minutes, released Wednesday, offered no substantive information leaving markets waiting for Friday’s PCE Price Index release. Nonetheless, despite falling initial jobless claims Thursday and a higher-than-expected PCE Price Index release Friday, crude oil prices rose almost 2% Thursday and then another 1% Friday on reports Russia planned to significantly increase production cutbacks in March. Adding to upward price pressures were expectations of increased Chinese demand.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Feb 24

27 February, 2023 | Jeff Klearman

WTI Crude oil prices ended the week slightly lower, belying intraweek volatility fostered by competing demand and supply concerns. Sharply lower Tuesday, prices reacted to growing concerns of Fed-induced demand destruction in the face of a seemingly resilient job market and economy. FOMC minutes, released Wednesday, offered no substantive information leaving markets waiting for Friday’s PCE Price Index release. Nonetheless, despite falling initial jobless claims Thursday and a higher-than-expected PCE Price Index release Friday, crude oil prices rose almost 2% Thursday and then another 1% Friday on reports Russia planned to significantly increase production cutbacks in March. Adding to upward price pressures were expectations of increased Chinese demand.

Spot gold prices moved lower last week as well. Tuesday’s CPI release showing slowing inflation combined with Wednesday’s strong retail sales report revived concerns of higher rates with growing expectations the Fed would continue to tighten and leave rates higher longer than currently expected. Down 1.5% through Thursday, gold prices moved higher over the last 2 days of the week on increased safe-haven demand following decent stock market declines. Silver and platinum prices moved lower as well.

Topic: Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Feb 17

21 February, 2023 | Jeff Klearman

Spot gold prices moved lower last week as well. Tuesday’s CPI release showing slowing inflation combined with Wednesday’s strong retail sales report revived concerns of higher rates with growing expectations the Fed would continue to tighten and leave rates higher longer than currently expected. Down 1.5% through Thursday, gold prices moved higher over the last 2 days of the week on increased safe-haven demand following decent stock market declines. Silver and platinum prices moved lower as well.